Commoditized Wisdom: Report (Week Ending March 22, 2024)

Posted:

Key points

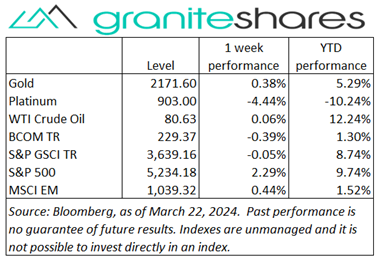

Mixed week for energy prices. Natural gas up 1%. Gasoline price up less than ½ percent and crude oil prices unchanged. Heating oil prices down 2%.

Mixed week for energy prices. Natural gas up 1%. Gasoline price up less than ½ percent and crude oil prices unchanged. Heating oil prices down 2%.- Wheat prices up 4% to 5%, corn prices higher by less than 1% and soybean prices lower by about ½ percent.

- Spot gold prices up about ½ percent. Spot silver and platinum prices down 2% and 4%, respectively.

- Copper and zinc prices lower by 3%. Nickel and lead prices down 4%. Aluminum prices up 2%.

- The Bloomberg Commodity Index increased fell 0.4%, primarily due to losses in the base metals sector.

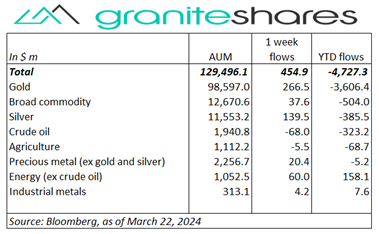

- More inflows again this week across all categories except energy, primarily from gold and silver ETPs

Commentary

Another up-week for major stock indexes. All 3 major stock indexes climbed to new highs last week, buoyed by FOMC dot plot projections of 3 rate cuts this year, easing concerns of more restrictive Fed policy. Stock markets moved higher every day but Friday, led by growth stocks and other interest rate sensitive sectors. Despite a dovish tone from Fed Chair Powell following the FOMC meeting Wednesday, the U.S. dollar noticeably strengthened while, interestingly, the 10-year Treasury rates dropped by over 10bps. Much better-than-expected existing home sales (released Thursday) also lent support to stock prices. For the week, the S&P 500 Index rose 2.3% to 5,234.18, the Nasdaq Composite Index gained 2.9% to 16,428.82, the Dow Jones Industrial Average increased 2.0% to 39,465.64, the 10-year U.S. Treasury rate fell 11bps to 4.20% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) appreciated 1.0%.

Another up-week for major stock indexes. All 3 major stock indexes climbed to new highs last week, buoyed by FOMC dot plot projections of 3 rate cuts this year, easing concerns of more restrictive Fed policy. Stock markets moved higher every day but Friday, led by growth stocks and other interest rate sensitive sectors. Despite a dovish tone from Fed Chair Powell following the FOMC meeting Wednesday, the U.S. dollar noticeably strengthened while, interestingly, the 10-year Treasury rates dropped by over 10bps. Much better-than-expected existing home sales (released Thursday) also lent support to stock prices. For the week, the S&P 500 Index rose 2.3% to 5,234.18, the Nasdaq Composite Index gained 2.9% to 16,428.82, the Dow Jones Industrial Average increased 2.0% to 39,465.64, the 10-year U.S. Treasury rate fell 11bps to 4.20% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) appreciated 1.0%.

Oil prices ended the week practically unchanged buffeted by conflicting signals of strength and weakness. Prices rose early in the week propelled by Ukraine attacks on Russian refineries, better-than-expected China manufacturing activity and retail sales and concerns of reduced production from Iraq and Suadi Arabia. Those gains were reversed by signs of weakened gasoline demand, uncertainty surrounding Fed policy and a stronger U.S. dollar.

Spot gold prices moved noticeably higher early last week, jumping almost 1.5% higher Wednesday following an as-expected FOMC rate decision along with dovish Fed Chair Powell comments and a better-than-expected dot plot release. Price gains reversed over Thursday and Friday on a stronger U.S. dollar and perhaps on profit taking. Silver and platinum prices moved lower moving more in step with base metal prices.

Copper prices moved lower last week giving up gains from the previous week (from Chinese smelter voluntary production cutbacks). Better-than-expected Chinese economic data lent support to prices while a stronger U.S. dollar pressured prices lower. Aluminum prices rose on expectations of strong Chinese demand.

Wheat prices rose almost 5% over the week bolstered by Russia drone attacks in the Odessa region of Ukraine and talks of EU grain-related import tariffs. Corn prices moved slightly on higher on good export inspections and increased ethanol production while soybean prices fell on a good Brazil harvest and increased selling and poor U.S. exports.

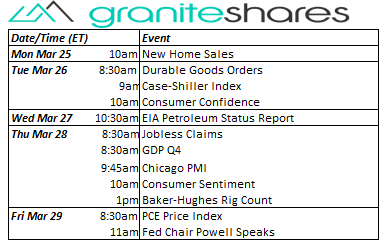

Coming Up This Week

New Home Sales, Durable Goods Orders, Consumer Confidence and Sentiment all this week. The always-influential PCE Price Index also this week but released Friday when markets are closed for Good Friday.

New Home Sales, Durable Goods Orders, Consumer Confidence and Sentiment all this week. The always-influential PCE Price Index also this week but released Friday when markets are closed for Good Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.