Commodities & Precious Metals Weekly Report: Sep 24

Posted:

Key points

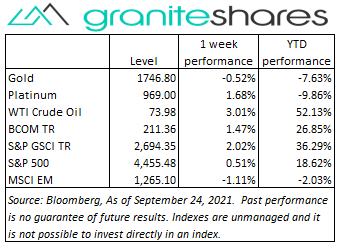

Energy prices were all higher again last week. WTI and Brent crude oil prices increased 3% and 3.5%, respectively and gasoline and natural gas prices rose a little over 1%. Gasoil prices increased 4%.

Energy prices were all higher again last week. WTI and Brent crude oil prices increased 3% and 3.5%, respectively and gasoline and natural gas prices rose a little over 1%. Gasoil prices increased 4%.- Grain prices were mainly higher. Chicago and Kansas wheat prices rose 2% and 1%, respectively while corn and soybean prices were basically unchanged. Soybean oil prices rose almost 3%.

- Precious metal prices were mixed. Gold spot prices (London PM settle) decreased ½ percent, though December CME futures prices ended the week unchanged. Platinum prices rose 1.7% and silver prices increased just under ½ percent.

- Base metal prices were all higher. Aluminum and copper prices increased 0.9% and zinc prices increased 1.3%. Nickel prices were slightly higher, increasing 0.1%.

- The Bloomberg Commodity Index rose 1.5%. Gains in the energy sector were primarily responsible for the increase but all sectors posted positive performance.

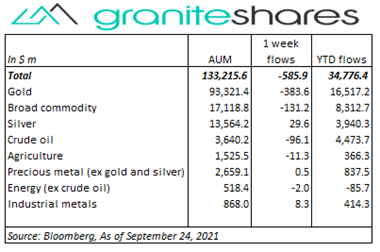

- Almost $600 million ETP outflows last week primarily form gold (-$384m), broad commodity (-$131m) and crude oil (-$96m) ETP outflows. Silver and base metal ETPs had small inflows.

Commentary

U.S. stock markets began last week on uneasy terms with Evergrande contagion concerns and FOMC announcement anxiety pushing all three major indexes about 2% lower. U.S stock markets, stagnating on Tuesday, moved higher the rest of the week, fortified by a somewhat-as-expected FOMC announcement and optimism Evergrande would avoid immediate default. Wednesday’s FOMC announcement indicated the Fed would likely begin tapering November (with bond buybacks to be eliminated by June next year) with at least one rate hike in 2022 followed by another 2-3 hikes in 2023. The Fed’s willingness to slightly and gradually tighten its ultra-easy monetary policy signaled it believed the U.S. economy was strong and at the same time eased investor concerns of possible fallout from Fed inaction. Interestingly, the 10-year U.S Treasury rate, down 6bps through Wednesday, jumped 13bps higher Thursday and another 2bp Friday perhaps as a delayed reaction to the FOMC announcement and perhaps as a result of lessened Evergrande contagion fears. For the week, the S&P 500 Index rose 0.5% to 4,455.48, the Nasdaq Composite Index was almost unchanged at 15,047.70, the Dow Jones Industrial Average increased 0.6% to 34,797.60, the 10-year U.S. Treasury rate increased 9bps to 1.45% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.1% percent.

U.S. stock markets began last week on uneasy terms with Evergrande contagion concerns and FOMC announcement anxiety pushing all three major indexes about 2% lower. U.S stock markets, stagnating on Tuesday, moved higher the rest of the week, fortified by a somewhat-as-expected FOMC announcement and optimism Evergrande would avoid immediate default. Wednesday’s FOMC announcement indicated the Fed would likely begin tapering November (with bond buybacks to be eliminated by June next year) with at least one rate hike in 2022 followed by another 2-3 hikes in 2023. The Fed’s willingness to slightly and gradually tighten its ultra-easy monetary policy signaled it believed the U.S. economy was strong and at the same time eased investor concerns of possible fallout from Fed inaction. Interestingly, the 10-year U.S Treasury rate, down 6bps through Wednesday, jumped 13bps higher Thursday and another 2bp Friday perhaps as a delayed reaction to the FOMC announcement and perhaps as a result of lessened Evergrande contagion fears. For the week, the S&P 500 Index rose 0.5% to 4,455.48, the Nasdaq Composite Index was almost unchanged at 15,047.70, the Dow Jones Industrial Average increased 0.6% to 34,797.60, the 10-year U.S. Treasury rate increased 9bps to 1.45% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.1% percent.

After falling almost 2.5% Monday over the possible fallout from Evergrande contagion, WTI crude oil prices rose every day the remainder of the week, closing the week near 3-year highs. Strong demand, falling inventory levels in the U.S. and abroad, OPEC+ production difficulties and continued Gulf of Mexico production problems all helped to lift oil prices higher. Another factor contributing to higher oil prices has been skyrocketing natural gas prices. Historically low global inventory levels and Russian production problems combined with strong demand have led to doubling of natural gas prices causing utilities to use or consider substituting oil.

Up over 1.5% through Wednesday, supported by Evergrande contagion fears and uncertainty surrounding the 2-day FOMC meeting, gold futures prices (December expiration) dropped 1.6% Thursday as contagion fears abated and investors digested Wednesday’s FOMC announcement. Wednesday’s FOMC announcement indicated the Fed would likely begin tapering November (with bond buybacks to be eliminated by June next year) with at least one rate hike in 2022 followed by another 2-3 hikes in 2023. 10-year U.S Treasury rates, down 6bps through Wednesday, jumped 13bps Thursday, contributing to the weakness in gold prices. Nonetheless, 10-year real yields remain near historical lows, closing near -90bps Friday.

Base metal prices followed U.S. equity markets, moving lower early in the week on Evergrande contagion fears, Fed tapering concerns and Chinese steel production cutbacks. Prices mainly moved higher the remainder of the week as contagion fears lessened and as investors digested Wednesday’s FOMC announcement. Copper prices, for example, down 3% Monday, closed up 1% on the week.

Grain prices followed equity markets as well falling Monday and then increasing the remainder of the week, perhaps reacting to Evergrande contagion fears and the onset of the approach of the 2-day FOMC meeting. The beginning of harvest season and better-than-expected crop conditions pressured soybean and corn prices as well.

Coming up this week

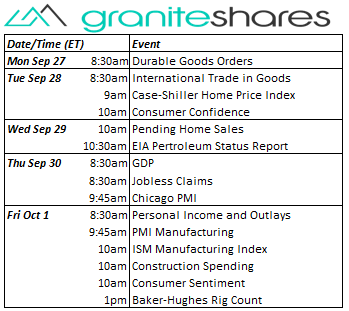

A busy data-week, highlighted GDP, Consumer Confidence and ISM and PMI indexes Friday.

A busy data-week, highlighted GDP, Consumer Confidence and ISM and PMI indexes Friday.- Durable Goods Orders on Monday.

- International Trade in Goods, Case-Shiller Home Price Index and Consumer Confidence on Tuesday.

- Pending Home Sales on Wednesday.

- GDP, Jobless Claims and Chicago PMI on Thursday

- Personal Income and Outlays, PMI and ISM Manufacturing Indexes, Construction Spending and Consumer Sentiment on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.