Commodities & Precious Metals Weekly Report: Jan 19

Posted:

Key points

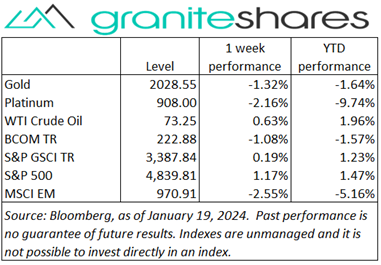

Energy prices, except for natural gas prices, were higher. WTI and Brent crude oil and heating oil prices were up less than 1%. Gasoline prices rose 2% and gasoil prices increased 1%. Natural gas prices dropped 14%.

Energy prices, except for natural gas prices, were higher. WTI and Brent crude oil and heating oil prices were up less than 1%. Gasoline prices rose 2% and gasoil prices increased 1%. Natural gas prices dropped 14%.- Grain prices again were all lower. Wheat, corn and soybean prices fell about 1%.

- Spot gold prices fell 1%, spot silver prices lost 2% and platinum prices were only slightly lower.

- Base metal prices were mixed. Aluminum, zinc and nickel prices fell 2%. Copper and lead prices increased 1%.

- The Bloomberg Commodity Index fell 1.1% mainly due to sharply lower natural gas prices. The softs sector was the only sector with gains.

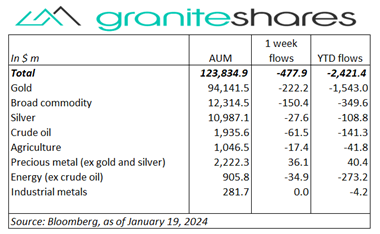

- Outflows predominately from gold, broad commodity and energy ETPs. Small inflows into precious metals (ex-gold and sliver) ETPs.

Commentary

Stock markets moved higher again last week and once again the Nasdaq Composite Index sharply outperformed both the S&P 500 Index and the Dow Jones Industrial Average. All 3 indexes moved lower through Wednesday, hurt by diminishing rate-cut expectations exacerbated by a stronger-than-expected retail sales release Wednesday. Thursday’s improved outlook forecast by Taiwan Semiconductor pushed chip-related stocks even higher, benefiting, in particular, the Nasdaq Composite Index but providing upward momentum to the S&P 500 Index and the Dow Jones Industrial Average as well. A lower-than-expected initial jobless claims number combined with improved consumer sentiment (as measured by the University of Michigan Consumer Confidence Index) added to rate-cut uncertainty and capped stock market gains. Reflecting “higher-rates-for-longer” concerns, the 10-year Treasury rate rose 19bps, almost entirely due to rising 10-year real rates, and the U.S. dollar strengthened just under 1 percent. For the week, the S&P 500 Index rose 1.2% to 4,839.81, the Nasdaq Composite Index gained 2.3% to 15,310.97, the Dow Jones Industrial Average increased 0.7% to 37,863.60, the 10-year U.S. Treasury rate 18bps to 4.13% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.8%.

Stock markets moved higher again last week and once again the Nasdaq Composite Index sharply outperformed both the S&P 500 Index and the Dow Jones Industrial Average. All 3 indexes moved lower through Wednesday, hurt by diminishing rate-cut expectations exacerbated by a stronger-than-expected retail sales release Wednesday. Thursday’s improved outlook forecast by Taiwan Semiconductor pushed chip-related stocks even higher, benefiting, in particular, the Nasdaq Composite Index but providing upward momentum to the S&P 500 Index and the Dow Jones Industrial Average as well. A lower-than-expected initial jobless claims number combined with improved consumer sentiment (as measured by the University of Michigan Consumer Confidence Index) added to rate-cut uncertainty and capped stock market gains. Reflecting “higher-rates-for-longer” concerns, the 10-year Treasury rate rose 19bps, almost entirely due to rising 10-year real rates, and the U.S. dollar strengthened just under 1 percent. For the week, the S&P 500 Index rose 1.2% to 4,839.81, the Nasdaq Composite Index gained 2.3% to 15,310.97, the Dow Jones Industrial Average increased 0.7% to 37,863.60, the 10-year U.S. Treasury rate 18bps to 4.13% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.8%.

Oil prices moved slightly higher last week, pushed and pulled by Mideast tensions and U.S. supply disruptions (due to extreme cold in some states) on the one hand and a stronger dollar and a faltering Chinese economy on the other. Prices did get an additional boost Thursday, buoyed by higher demand forecasts from both the IEA and OPEC. Natural gas prices dropped sharply, falling almost 14% with look-forward oversupply concerns offsetting current cold weather increased demand.

Spot gold prices moved lower last week, affected by diminished expectations of Fed rate cuts this year. A better-than-expected retails sales report, lower-than-expected initial jobless claims and hawkish Fed officials’ comments throughout the week, worked to pressure prices lower. Prices partially recovered Thursday and Friday, spurred by safe-haven buying related to Red Sea/Houthi events. Silver prices underperformed gold prices while platinum prices, also lower, outperformed gold prices.

Copper prices moved higher last week despite weak Chinese economic data. A weaker-than-expected Chinese GDP release and sharply falling Chinese property sales worked to pressure prices lower while markedly low LME inventory levels and growing expectations of Chinese stimulus acted to moved prices higher. A stronger U.S. dollar hurt base metal prices as well with most other metal prices ending lower on the week.

Grain prices were once again lower last week. Prices continued to be affected by the previous week’s bearish WASDE report with oversupply concerns dominating the market. Weak Chinese economic data also pressured prices early in the week with markets expecting, as a result, weak Chinese buying demand. However, those concerns were somewhat waylaid by flash soybean sales to China and decent sales to Mexico. A stronger U.S. dollar also pressured prices lower.

Coffee prices moved sharply higher last week (up 9%). Arabian coffee prices moved markedly higher reacting to shipping Red Sea shipping difficulties.

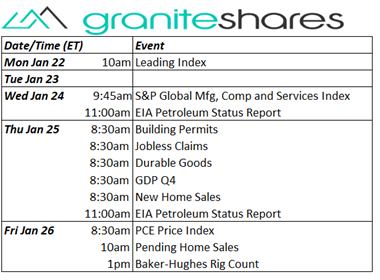

Coming Up This Week

Manufacturing, Composite and Services PMI Indexes, Q4 GDP and PCE Price Index are the focus this week.

Manufacturing, Composite and Services PMI Indexes, Q4 GDP and PCE Price Index are the focus this week.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.