Commoditized Wisdom: Metals & Markets Update #52

Posted:Key points

Energy prices were mixed last week. Natural gas and gasoline prices moved higher while crude oil, gasoil and heating oil prices moved lower. WTI crude oil prices were slightly lower last week, falling about 0.1%, while gasoil and heating oil prices fell close to 3%. Natural gas prices increased 2% and gasoline prices rose a little over 1%.

Energy prices were mixed last week. Natural gas and gasoline prices moved higher while crude oil, gasoil and heating oil prices moved lower. WTI crude oil prices were slightly lower last week, falling about 0.1%, while gasoil and heating oil prices fell close to 3%. Natural gas prices increased 2% and gasoline prices rose a little over 1%.- Grain prices were all higher last week. Wheat prices jumped close to 5% and corn and soybean prices rose about ¾ of a percent.

- Base metal prices were all higher as well. Zinc and nickel prices increased the most with zinc prices up almost 4% and nickel prices higher by a little more than 2%. Copper prices increased about 2% and aluminum prices increased 1%.

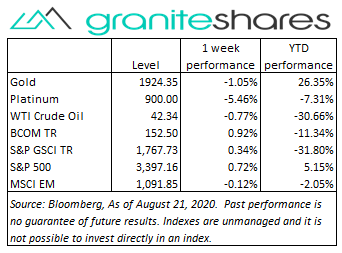

- Gold and platinum prices were lower last week while silver prices rose. Gold prices fell about 1% and platinum prices decreased about 5.5%. Silver prices increased just under 2.5%.

- The Bloomberg Commodity Index rose yet again last week, increasing 0.92%. The grains and base metals sectors were primarily responsible for the increase. No sector had negative performance.

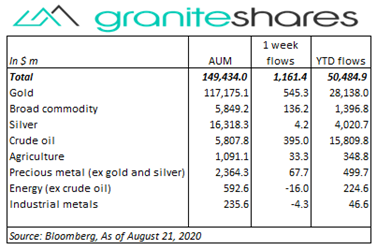

- Commodity ETP assets increased by almost $1.2 billion last week, resuming their climb higher after the previous week’s drawdown. Gold ($545.3m), crude oil ($395.3m) and broad commodity ($136.2m) ETP inflows were primarily responsible for the increase. There were no significant outflows.

Commentary

Moving higher on much-stronger-than-expected housing starts data, the S&P 500 Index reached an all-time closing high on Tuesday, surpassing its record closing last set in February of this year. Wednesday’s release of FOMC minutes pushed the S&P 500 Index off its record high with the minutes revealing U.S. Federal Reserve Bank concerns about the wherewithal of the U.S. economic recovery and the need for further fiscal stimulus. Despite a higher-than-expected jobless claims number on Thursday and continued coronavirus concerns, U.S. stock markets moved higher the remainder of the week supported mainly by strength in tech stocks. At week’s end the S&P 500 Index increased 0.7% to a record closing level of 3,397.16, the Nasdaq Composite index rose 2.7% to 11,311.80, the 10-year U.S. interest rate fell 8 bps to 63 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.2%.

Moving higher on much-stronger-than-expected housing starts data, the S&P 500 Index reached an all-time closing high on Tuesday, surpassing its record closing last set in February of this year. Wednesday’s release of FOMC minutes pushed the S&P 500 Index off its record high with the minutes revealing U.S. Federal Reserve Bank concerns about the wherewithal of the U.S. economic recovery and the need for further fiscal stimulus. Despite a higher-than-expected jobless claims number on Thursday and continued coronavirus concerns, U.S. stock markets moved higher the remainder of the week supported mainly by strength in tech stocks. At week’s end the S&P 500 Index increased 0.7% to a record closing level of 3,397.16, the Nasdaq Composite index rose 2.7% to 11,311.80, the 10-year U.S. interest rate fell 8 bps to 63 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.2%.

WTI crude oil prices up almost 2% through Wednesday on strong OPEC+ cutback-compliance, indications of increased Chinese buying and falling U.S. inventories, moved lower Thursday and Friday on weaker-than-expected economic reports out of Europe, Japan and the U.S. A larger-than-expected decline in U.S. gasoline inventories helped move gasoline prices higher last week. Despite a larger-than-expected build in inventories reported Thursday by the EIA, natural gas prices moved higher on the week supported by strong LNG demand, heat waves in parts of the U.S. and concerns surrounding tropical storms potentially affecting production in the Gulf.

Up over 3% through Tuesday on a weaker U.S. dollar, falling U.S. Treasury rates and reports Berkshire Hathaway increased its holdings of Barrick Gold Corp, gold prices fell sharply on Wednesday following the release of FOMC minutes. Despite U.S. Federal Reserve Bank concerns over the wherewithal of the U.S. economic recovery, market participants instead focused on the rebound in consumer spending mentioned in the minutes. Silver prices behaved similarly to gold prices, increasing 7.5% through Wednesday and ending the week up approximately 2.5%.

Copper prices climbed to a two-year high on Wednesday, increasing almost 5.5% on the back of falling inventory levels, supply concerns and large Chinese fiscal stimulus. Following weaker-than-expected economic reports in the U.S, Europe and Japan, copper prices retreated, falling 3.5% from their highs reached Wednesday. Nickel and zinc prices also benefited from supply concerns as well as from strong stainless steel demand.

Corn prices continue to rise on the back of damage assessments following the previous week’s derecho storm in the Midwest. Soybean prices moved higher on dry weather conditions (negatively affecting crops) and continued strong Chinese demand. Wheat prices, up close to 5% on the week, benefited from adverse weather conditions in Argentina, forecasts of lower-than-expected yields in Russia and strong Chinese demand.

Coming up this week

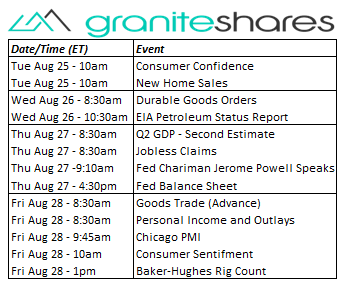

Busier data-week highlighted by Fed Chairman Jerome Powell speaking on Thursday.

Busier data-week highlighted by Fed Chairman Jerome Powell speaking on Thursday.- Consumer Confidence and New Home Sales on Tuesday.

- Durable Goods Orders on Wednesday.

- Second estimate of Q2 GDP, Jobless Claims, Jerome Powell spreaks and the Fed Balance Sheet on Thursday.

- Goods Trade, Personal Income and Outlays, Chicago PMI and Consumer Sentiment on Friday.

- EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.