Commodities & Precious Metals Weekly Report: Nov 17

Posted:

Key points

Energy prices mostly moved lower again last week. Oil and gasoline prices fell about 1% and natural gas prices lost 5%. Heating oil and gasoil prices rose about 1%.

Energy prices mostly moved lower again last week. Oil and gasoline prices fell about 1% and natural gas prices lost 5%. Heating oil and gasoil prices rose about 1%.- Grain prices were mixed. Wheat prices fell 4% and soybean prices dropped about 1%. Corn prices increased 1%.

- Spot gold prices gained 2%, spot silver and platinum prices rose 7% and palladium prices gained 10%.

- Zinc and aluminum prices fell under 1% and nickel prices lost 2%. Copper prices rose 4% and lead prices increased 5%.

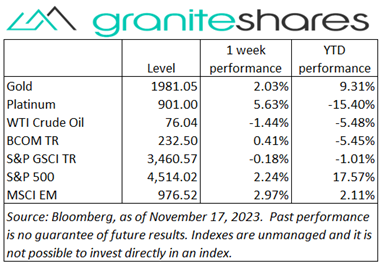

- The Bloomberg Commodity Index increased 0.4%. Precious and base metals sector gains were partially offset by losses in the grains and energy sectors.

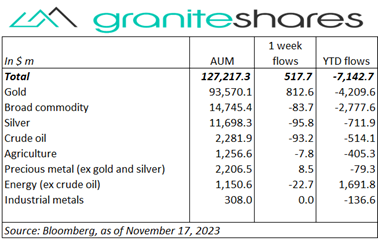

- Larger inflows into gold ETPs with smaller outflows from almost every other ETP sector.

Commentary

Stock markets moved higher once again last week, this time buoyed by lower-than-expected inflation readings and weaker-than-expected economic data. Most of last week’s gains were registered Tuesday following a CPI release showing cooling inflation, boosting expectations of “peak rates” and moving up investor estimates of a Fed pivot. Wednesday’s PPI (better-than-expected) and retail sales (weaker-than-expected) releases supported markets, slightly extending gains through the end of the week as did Thursday’s larger-than-expected jobless claims. 10-year Treasury rates dropped 20bps over the week, with falling real rates responsible for the vast majority of the decline. For the week, the S&P 500 Index rose 2.2% to 4,514.02, the Nasdaq Composite Index gained 2.4% to 14,125.48 the Dow Jones Industrial Average increased 1.9% to 34,947.28, the 10-year U.S. Treasury rate fell 21bps to 4.44% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 1.9%.

Stock markets moved higher once again last week, this time buoyed by lower-than-expected inflation readings and weaker-than-expected economic data. Most of last week’s gains were registered Tuesday following a CPI release showing cooling inflation, boosting expectations of “peak rates” and moving up investor estimates of a Fed pivot. Wednesday’s PPI (better-than-expected) and retail sales (weaker-than-expected) releases supported markets, slightly extending gains through the end of the week as did Thursday’s larger-than-expected jobless claims. 10-year Treasury rates dropped 20bps over the week, with falling real rates responsible for the vast majority of the decline. For the week, the S&P 500 Index rose 2.2% to 4,514.02, the Nasdaq Composite Index gained 2.4% to 14,125.48 the Dow Jones Industrial Average increased 1.9% to 34,947.28, the 10-year U.S. Treasury rate fell 21bps to 4.44% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 1.9%.

A volatile week for oil prices, falling sharply Wednesday and Thursday and then rising significantly Friday. Prices rose early in the week on OPEC demand forecasts only to succumb to both larger-than-expected U.S. inventory increases and weak economic data from the U.S. (jobless claims, retail sales) and China demand concerns (markedly lower refinery runs). Prices partially recovered Friday, boosted by short-covering and, to some extent, U.S. sanctions on shippers of Russian oil.

Spot gold prices rose last week, benefiting from a combination of cooling inflation and weaker-than-expected economic data. Tuesday’s better-than-expected CPI release pushed 10-year Treasury rates almost 20bps lower and significantly weakened the U.S. dollar, driving gold prices higher. Declining PPI and retail sales numbers (MoM) combined with larger-than-expected initial jobless claims, added to expectations of a Fed pivot sooner than previously expected, adding to upward price momentum. Silver, platinum and palladium prices also rose last week, outperforming gold prices.

Copper prices moved higher every day but Thursday last week, reacting to falling inflation (globally), a significantly weaker U.S. dollar and better-than-expected economic data out of China. Supply concerns (potential Panama mining issues) added to upward price pressure while China’s weak property sector capped gains.

Wheat prices moved lower last week, pressured by cheap Russian export prices and oversupply concerns in the U.S. and globally. Corn prices moved higher on balance due to strong exports and lingering South America weather concerns. Soybean prices moved sharply higher Monday on surging meal demand only to give up those gains and more the remainder of the week on potentially improved weather conditions for parts of Argentina and Brazil.

Coming Up This Week

Lighter holiday data-week but holding some important releases such as Existing Home Sales, FOMC Minutes and Durable Goods Orders.

Lighter holiday data-week but holding some important releases such as Existing Home Sales, FOMC Minutes and Durable Goods Orders.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.