A Decade of Stock Returns: Chart of the Week

Posted:

Topic:

Gold

Publication Type:

Investment Cases

A Case for Diversification?

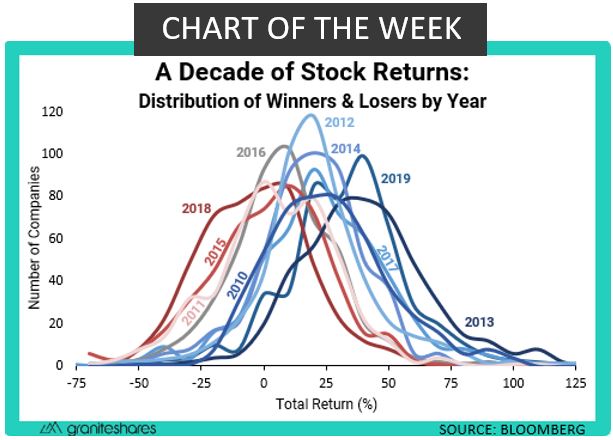

Stock market returns come in all shapes and size—how exactly does 2019’s 30% gain measure up? Breaking down a decade of S&P 500 stocks illustrates how lumpy equity returns can be, and the folly to simply trying pick winners. Just as important as the actual returns is how they are distributed, and this chart serves as a powerful visualization of how the risks we take are always changing. In an ever-fluid environment, diversifying with non-correlating assets such as gold may help manage the tail-end risks of equity markets.