US CPI Inflation Rate For February

Posted:

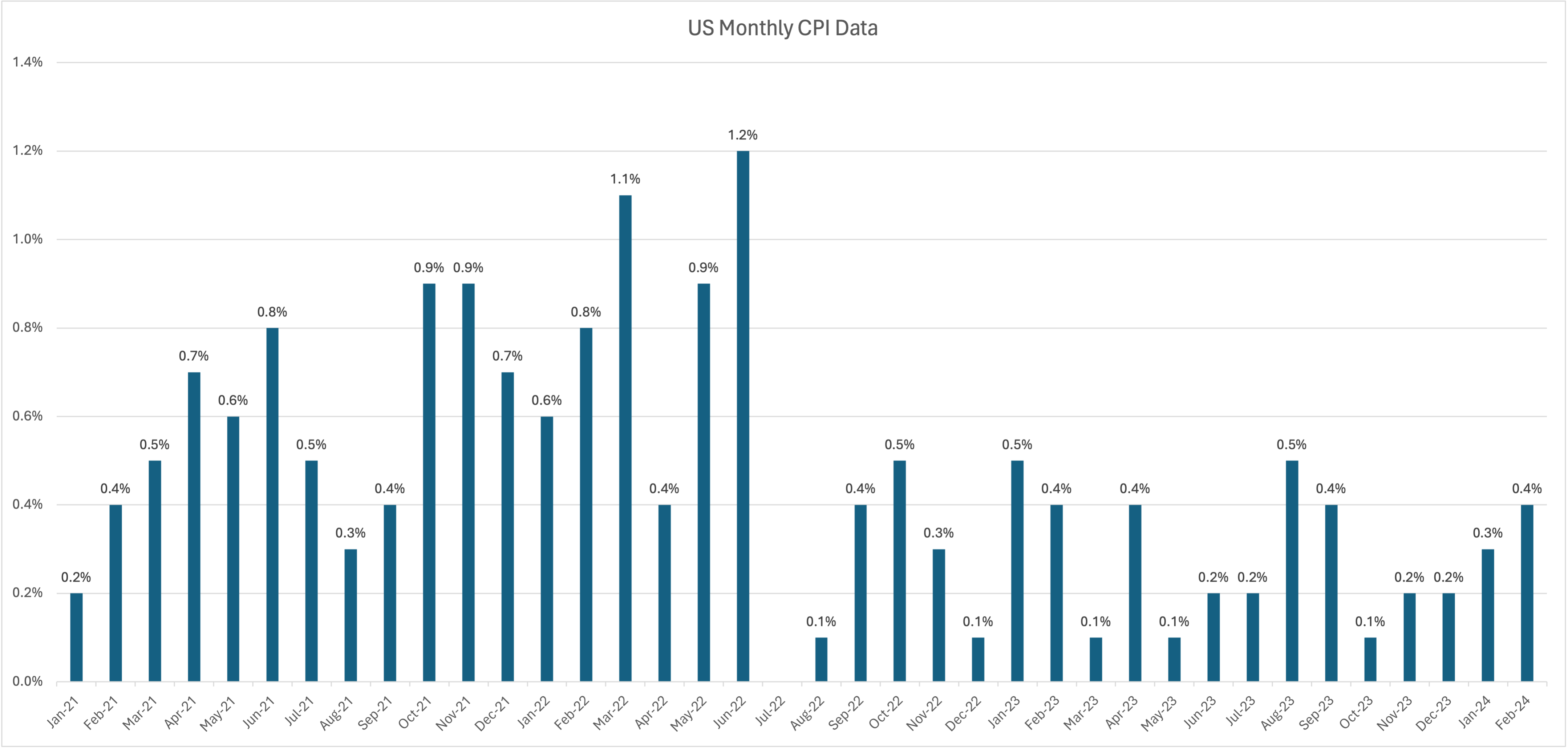

US CPI in February Increased by 0.4% from January and 3.2% on a YoY Basis

In February, the Consumer Price Index (CPI) rose by 0.4% on a seasonally adjusted basis, following a 0.3% increase in January. Over the past 12 months, the all-items index increased by 3.2% before seasonal adjustment, according to the U.S. Bureau of Labor Statistics.

Moreover, the index for all items excluding food and energy increased by 0.4 %, mirroring the rise seen in January. Several indexes experienced increases during the month, including shelter, airline fares, motor vehicle insurance, apparel, and recreation. However, the index for personal care and the index for household furnishings and operations decreased over the month.

Despite the 12-month pace of inflation moderating since its peak of 9.1% in mid-2022, it remains substantially higher than the Federal Reserve's 2% target as the central bank approaches its two-day policy meeting in a week.

A 2.3% surge in energy costs contributed significantly to the headline inflation figure. Meanwhile, food costs remained unchanged for the month, while shelter expenses increased by another 0.4%.

According to the Bureau of Labor Statistics (BLS), the combined increases in energy and shelter accounted for over 60% of the overall gain. Gasoline prices surged by 3.8% for the month, whereas owners’ equivalent rent, a theoretical measure estimating what homeowners could receive if they rented out their properties, increased by 0.4%.

The increase in inflation reported on March 12, 2024, was driven primarily by services such as motor insurance and health and has raised concerns that the Federal Reserve might need to postpone interest rate cuts from their current 23-year high, according to warnings issued.

Furthermore, the airline fares index surged by 3.6%, following a 1.4% increase in January. Additionally, the index for motor vehicle insurance rose by 0.9% during the month. Other notable increases in February were observed in apparel, recreation, and used cars and trucks.

The medical care index remained unchanged in February after a 0.5% rise in January. Within this category, the index for hospital services decreased by 0.6%, while the index for physicians' services decreased by 0.2%. The prescription drugs index also experienced a slight decline of 0.1%, whereas the index for dental services increased by 0.4%.

Contrarily, the index for personal care decreased by 0.5% in February, following a 0.6% increase in January. Similarly, the household furnishings and operations index, along with the new vehicles index, fell by 0.1% over the month.

Over the past 12 months, the index for all items excluding food and energy rose by 3.8%. The shelter index saw a notable increase of 5.7% over the last year, contributing to approximately two-thirds of the total 12-month increase in all items excluding the food and energy index. Other notable increases over the last year were observed in motor vehicle insurance (+20.6%), medical care (+1.4%), recreation (+2.1%), and personal care (+4.2%).

The thriving economy has provided the Federal Reserve with the flexibility to carefully consider incoming data, allowing policymakers to refrain from hastily lowering interest rates. Gross domestic product (GDP) expanded at an annualized pace of 2.5% in 2023 and is projected to continue growing at a similar rate of 2.5% in the first quarter of 2024, as indicated by the Atlanta Fed’s GDPNow tracker.

A crucial factor contributing to this growth is the resilient consumer base, bolstered by a robust labor market. In February, the economy saw the addition of 275,000 nonfarm jobs, although the majority of these were part-time positions. Despite this increase, the unemployment rate edged up to 3.9%.

Market Performance:

Two-year Treasury yields, which typically reflect rate expectations and exhibit an inverse relationship with prices, increased by 0.06% points to reach 4.59%.

Similarly, the benchmark 10-year yield rose by 0.05% points, reaching 4.15%.

Meanwhile, an index monitoring the dollar against a basket of six other currencies saw a 0.2% increase during the day.

Moreover, European markets ended on March 12 on a positive note as investors worldwide absorbed the latest U.S. inflation figures.

The Stoxx 600 index surged by 1%, building on gains from earlier in the day. Most sectors finished the session in positive territory, with automotive stocks leading the way with a 2.4% increase, while utilities experienced a 1.2% decline.

The FTSE 100 reached a 10-month high on Tuesday, jumping over 1.2% during afternoon trading as the slowdown in wage growth sparked optimism for potential interest rate cuts.

In early trading, U.S. stocks also climbed higher following the release of U.S. inflation data. The Dow Jones Industrial Average saw a gain of 235.83 points, or 0.61%, closing at 39,005.49. The S&P 500 edged up by 1.12%, reaching 5,175.27, surpassing the previous record high close set on March 7. The Nasdaq Composite rose by 1.54% to 16,265.64.

US stocks that gained were Shares of chipmaker Nvidia surged over 7%, while Microsoft gained 2.6%, and Meta rose by 3.3%. Oracle experienced a significant jump of more than 11% after exceeding Wall Street's earnings estimates.

Sources:

Leverage ETPs by GraniteShares

Leverage ETPs by GraniteShares

| Product name | Ticker | ||

|---|---|---|---|

| USD | EUR | GBX | |

| 3STS | 3STE | 3STP | |

| 3LTS | 3LTE | 3LTP | |

| 3SFT | 3S3E | 3S3P | |

| 3FTG | 3FTE | 3FTP | |

| FTNG | FTNE | FTNP | |

| SFTG | SFTE | SFTP | |

DISCLAIMER

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.