Compounding Impact

Posted:Leveraged ETP Securities are designed to deliver a daily percentage return, which means that the leverage factor is constant over time and also means that returns for holding periods longer than a day are subject to compounding.

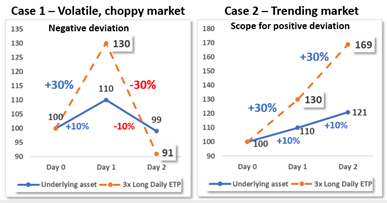

The impact of compounding results in the ETP performance deviating from the leverage factor. This can either be positive, implying outperformance, or negative, implying underperformance.

Volatile or directionless markets result in negative deviation, whereas trending markets, particularly over short time periods, may result in positive deviation as illustrated below

Note: Illustrative ETP performance before fees and adjustments

Key takeaway

Leveraged ETP Securities have a daily investment goal. Holding periods longer than one day will differ from the leveraged return of the underlying asset. The difference is likely to become even more pronounced as the holding period increases. Leveraged ETP Securities are designed to be held for short holding periods of one day.