Shell - Long or Short?

Posted:Shell - Long or Short?

Shell PLC (LON: SHEL) is formerly known as Royal Dutch Shell the international energy and petrochemical company formed through a merger of Royal Dutch Petroleum and ‘Shell’ Transport and Trading company in 1907. The company specializes in the exploration of oil and gas and produces fuels, chemicals, and lubricants. Shell is also involved in the marketing and shipping of oil products and chemicals, gas, oil production, and natural gas as well as electricity. In recent times, the company also seems interested in renewable sources of energy including wind, solar, and hydrogen.

The company’s business includes Upstream, Downstream, Integrated gas, and manufacturing and marketing of chemicals. The upstream business segment manages the exploration for and extraction of crude oil, natural gas liquids, and natural gas. The integrated gas segment of the business manages liquified natural gas activities and the production of gas-to-liquid fuels and other products. The downstream segment of the business consists of different chemicals and product activities as a part of the integrated value chain that trades and refines crude oil and various feedstock into a range of products that are moved and marketed across the world. Renewable and Energy segments include hydrogen, and power from renewable and low carbon sources including natural gas, solar, and wind.

Conventional Energy Sector:

In 2022, the oil and gas sector rebounded at a robust rate as compared to the last two years with oil prices reaching the highest level in the last 6 years. The increase in US onshore oil production and OPEC along with geopolitical strain in Europe has led to price volatility in commodities in April 2022. (Source: Deloitte sector Outlook)

Gasoline and diesel prices surged as well as the use of them increased since consumers resumed travel and business activity picked up. The entire year of 2022, crude oil is expected to reach consumption of 99.53 million barrels per day (bpd), up from 96.2 million bpd this year, according to the International Energy Agency.

These statistics will put pressure on OPEC as well as the US shale industry to meet the industry demand after one year since due to pandemic the demand for it had been dramatically reduced. In 2021, the demand for crude oil increased and OPEC countries and US shale has struggled to add additional output. During the start of 2021 crude oil started at $52 a barrel, it rose around $86 per barrel before tailing off at the end of the year.

There is still Omicron coronavirus variant looming and various countries have reimposed travel curbs which could hurt the aviation industry as well as consumption of oil.

The rebound in demand for crude oil prices in 2021 took suppliers by surprise since the previous year the price of crude oil plunged to the bottom and so did the demand for it. The plummet in the demand was from covid induced historic decline in demand also due to lockdown and travel curbs. With the 2021 rebound rose tensions between large producing countries and the biggest consumers like US, China, and India. In 2021the prices of gasoline rose sharply, US President Mr. Joe Biden called OPEC and its allies to come together and boost the overall output after restraining sully for months.

During the start of 2022, the covid cases of omicron variant increased which led to travel restriction in various countries. But the surge in oil and gas prices in this year was due to the global economic shock from Russia’s invasion of Ukraine. The oil jumped to $139 barrel at one point, the highest price in the last fourteen years. While the wholesale gas prices for next day delivery almost doubled. Due to the war that broke in the start of the year between Russia-Ukraine had led to various countries to reduce or boycott energy produced from Russia which has led to increase in production and demand from other countries.

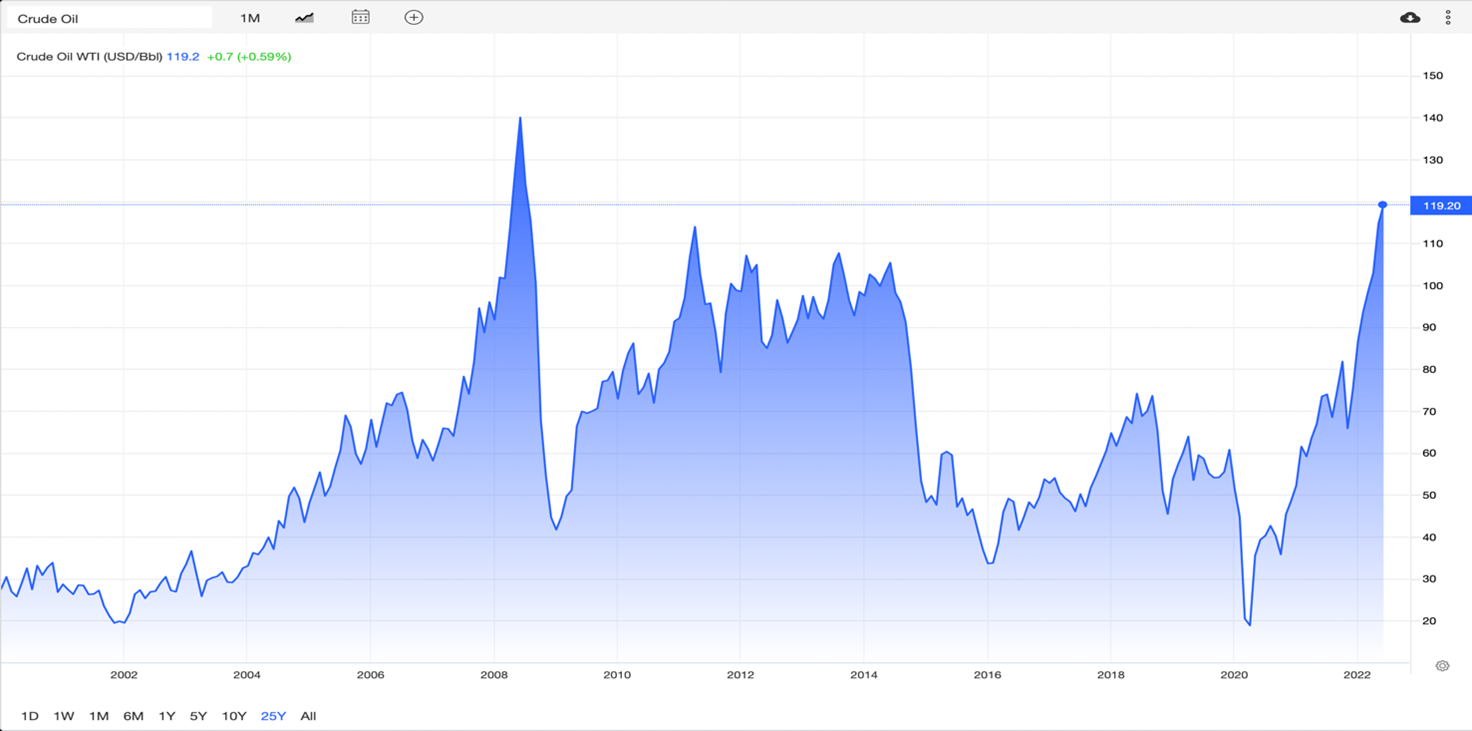

Crude Oil Prices:

Source: Trading economics – June 06, 2022

Earnings - Q1FY21

Petrol and energy giant reports the highest quarterly profit since 2008 as oil and gas prices surged followed Russia’s invasion of Ukraine. The company reported strong adjusted earnings of $9.1 billion in Q1FY22 amidst a volatile geopolitical and macroeconomic environment as compared to $3.2 billion at the same time last year and $6.4 billion in Q4FY21. It is triple earnings from $3.2 billion for Q1FY21 thereby beating out its previous record in 2008.

Adjusted EBITDA stood at $19 billion in Q1FY22 as compared to $16.3billion for Q4FY21 benefiting from higher commodity prices.

The company delivered $14.8 billion of cash from operations for quarter one this year which includes $7.4 billion of working capital outflow due to surging commodity prices. The $14.8 billion cash from operations reported by the company reflects net favorable derivatives movement of $2.2billion primarily led by the settlements of the derivatives contracts in the first quarter of 2022 for this the margin cash outflows have taken place in 2021also working capital outflow of $7.4 billion.

The company’s debt was reduced by 8%from $52.6 billion in Q4FY22 to $48.5 billion this quarter. The reduction in debt was primarily driven by free cash flow and partly offset by dividends and share buybacks during the quarter.

The stock market reacted positively to the quarterly results of the company despite the competitors also gaining an uptick in profits due to the oil price. Shells stock price rose by 3% in mid-morning on May 5, 2022, when Q1 results got released.

Russia - Ukraine Impact:

The company has written down around $3.9 billion in relation to Russian oil and gas activity. During 2022 when Russia invaded Ukraine the company limited and withdrew from Russia and their trading connections as well as winding down joint ventures which hampered the production and led to a rough start of the year.

The company also announced their intent to withdraw from the Russian hydrocarbon in a phased manner. Apart from that, Shell has also stopped buying Russian crude oil and liquified natural gas (LNG) on the spot market. Furthermore, they are also planning not to renew any long-term contracts with Russia.

Outlook:

The global demand for oil and gas production, marketing, as well as refining along with gasoline and diesels the increased since the consumer demand rose as the covid restriction has eased. The company expects for short term the crude oil prices to go up in a robust manner.

With volatility in the underlying asset investors can invest on a long-term basis and traders can opt to earn profits based on the oil and gas prices fluctuation.

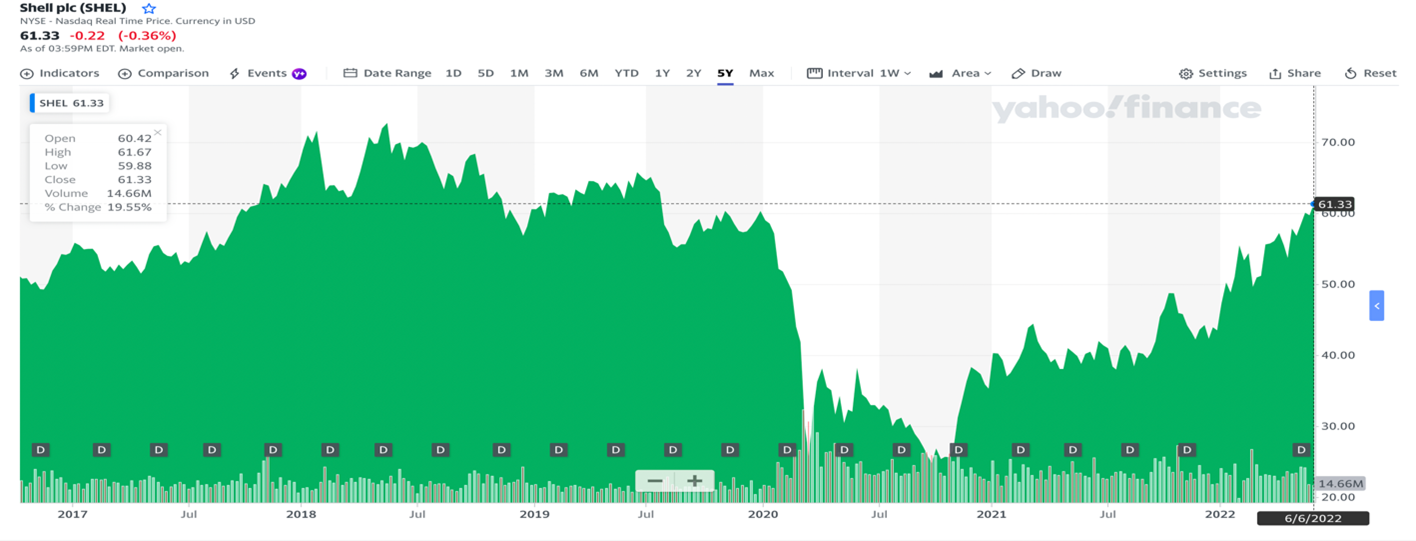

Shell Stock Performance:

Source: Yahoo Finance on June 09, 2022 (one week chart)

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Messels Limited which is authorized and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.