Apple

Apple, the company that revolutionized the computer world

Presentation of the company

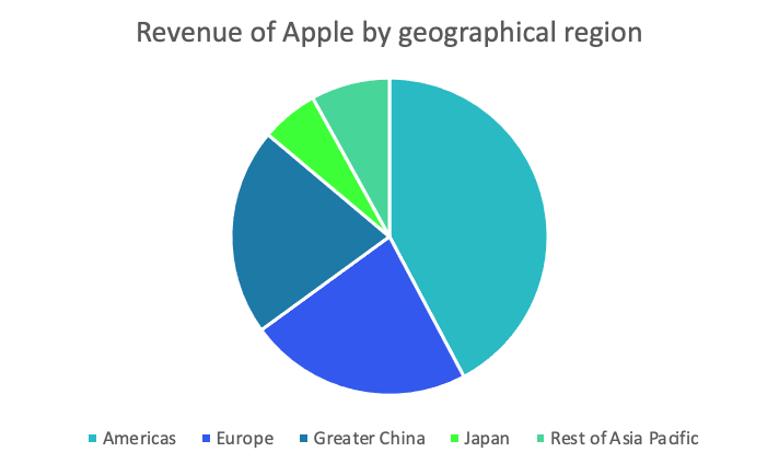

Apple is an American multinational company based in California that creates and markets electronic products, computers and software. The company's flagship products include the iPhone, the iPad, and the Macbook computer. Apple stores are present in 25 countries, and their website delivers to more than 39 countries. Apple products are nevertheless known worldwide, thanks to a strong marketing strategy based on innovation, original advertising, ergonomics, aesthetics of their products, and a remarkable sales and after-sales service. It is with this strategy that Apple has succeeded in making its customers identify with the brand and above all in building their loyalty.

Apple's biggest competitor is Samsung, in the phone market. It is also possible to consider Amazon and Microsoft in the tablet market.

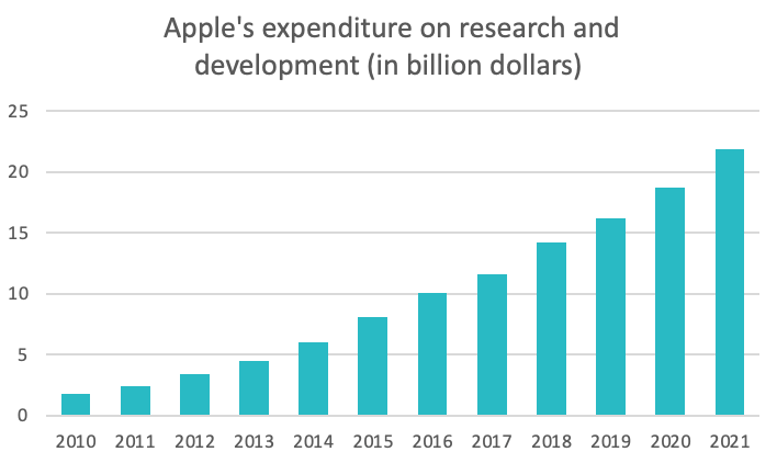

Source : macrotrends.com

>

Source : statista.com

History of Apple

Apple, formerly Apple Computer Inc. was founded on April 1, 1976 in Cupertino by Steve Jobs, Steve Wozniak and Ronald Wayne, and incorporated on January 3, 1977. At the beginning, Apple Computer was mainly a personal computer manufacturer, but it experienced difficult sales and a low market share in the 1990s, finding itself on the verge of bankruptcy in 1997. So Steve Jobs instituted a new corporate philosophy based on recognizable products and simple design, starting with the iMac in 1998. This was followed by the launch of the iPod, the Apple Store and the iTunes platform in 2001, creating a place in the consumer electronics and media sales industry.

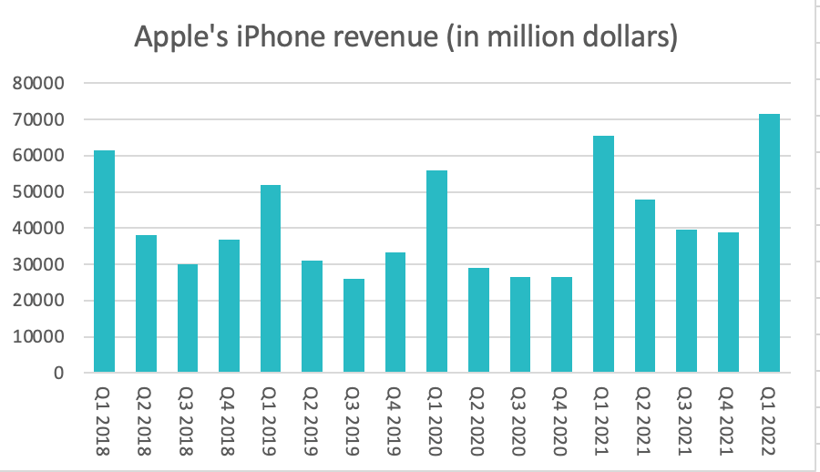

2007 was an important year for Apple, which decided to remove the word "Computer" from its name with the launch of the iPhone, which was a worldwide success and has since become the mainstay of the brand's sales.

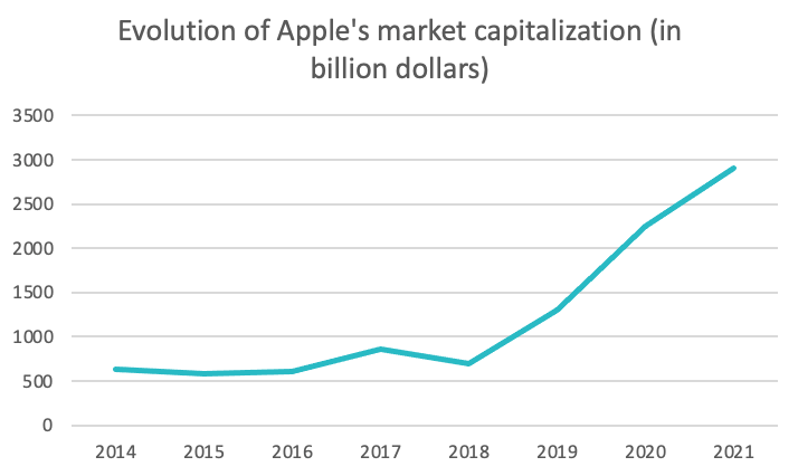

In August 2020, Apple becomes the first private company to exceed 2000 billion in market capitalization.

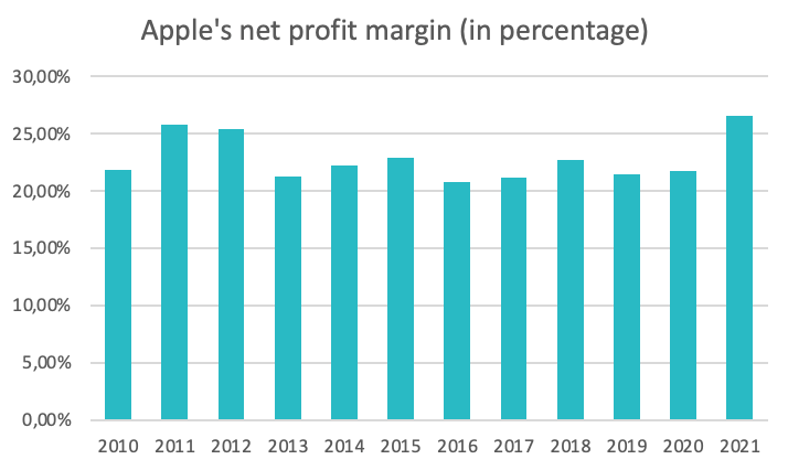

Source : macrotrends.com

Source : statista.com

Who is Steve Jobs, key element of Apple's success?

Steve Jobs, born in 1955 in California, is an American entrepreneur and investor, perceived as a visionary. He is an emblematic figure of consumer electronics, and a pioneer of the advent of the personal computer, the smartphone or the touch tablet.

Founding partner of Apple, he was finally removed from the group's management in 1985. Following this departure, he created NeXT, a company creating computers and software, where he developed his creativity and ideas. In 1997, Apple bought NeXT, and Steve Jobs got one and a half million Apple shares, giving him back a place in the company. A few months later, when Apple was on the verge of bankruptcy, he became CEO again, with the intention of "surpassing Microsoft and everyone else". This was followed by the release of the iMac, the iPod, the iPhone, and brilliant advertising campaigns that propelled the development of the company: Steve Jobs had succeeded in reviving Apple.

Battling illness for more than seven years, he decided to step down as CEO of Apple in 2011, appointing Tim Cook to take his place. He died the same year.

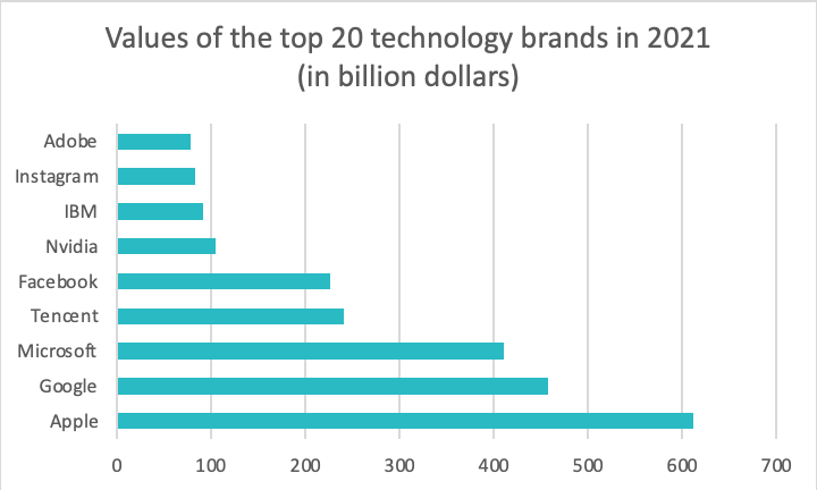

Source : statista.com

Source : macrotrends.com

The market

Apple is a company operating in the consumer electronics and technological innovation sector. This field is familiar to all of us, we all use electronic objects on a daily basis, whether it is our smartphone, our computer or our tablet. With new technologies and innovations being developed all the time, as well as the fact that these objects have a limited lifespan, it goes without saying that the demand is renewed, that customers are eagerly awaiting new items.

In today's world, innovations are made in an exponential way, the world is in constant research, and we are far from having explored all the possibilities that are offered to us. The new technologies and consumer electronics sectors, which go hand in hand, are therefore destined for a long life, and for many twists and turns in the near and distant future..

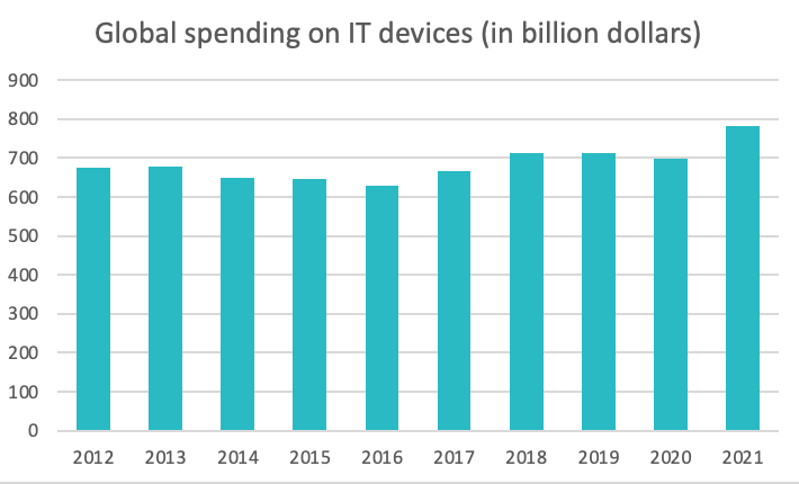

Source : statista.com

Source : statista.com

Key figures and financial ratios

Market capitalization: $22.82 trillion 1(May 13, 2022)

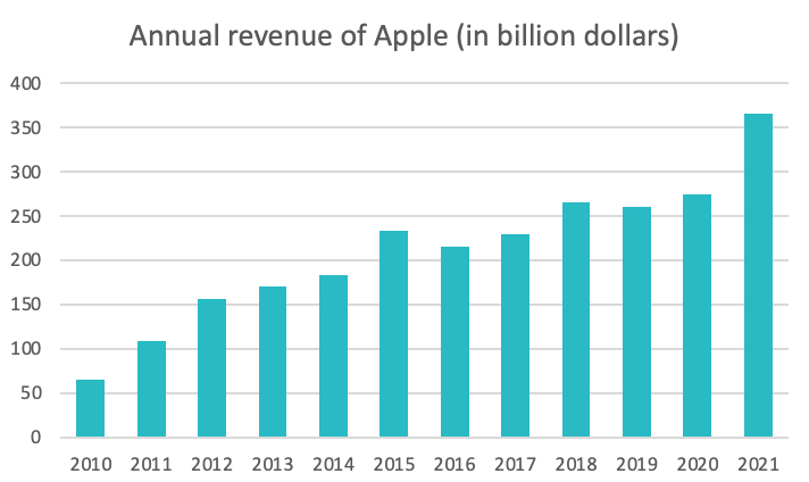

Turnover: $365.81 billion 2(2021)

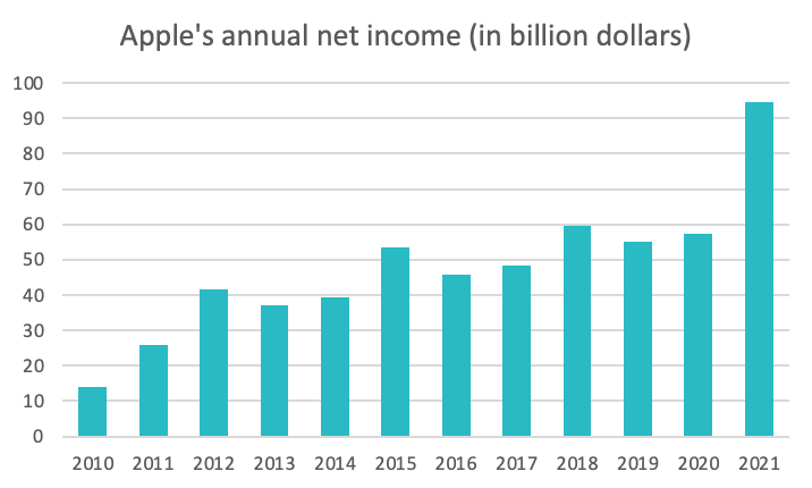

Net income: $94.68 billion 3(2021)

Dividends paid: $0.88; Paid without interruption since 2012, 4 times a year

Earnings per share: $5.614(2021)

Price-to-earnings ratio: ≃25.695(2022)

Debt-to-equity ratio: 1.7076(2022)

Source : statista.com

Source : statista.com

Graniteshares Offering Products

Apple

FAANG

GraniteShares FAANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Apple, Netflix and Alphabet

GAFAM

GraniteShares GAFAM ETPs provide exposure to the equal weight to following companies: Alphabet, Amazon, Facebook, Apple and Microsoft

FATANG

GraniteShares FATANG ETPs provide exposure to the equal weight to following companies: Facebook, Amazon, Tesla, Apple, Netflix and Alphabet

Sources

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. Graniteshares Limited is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks.