Commodities & Precious Metals Weekly Report: May 21

Posted:

Key points

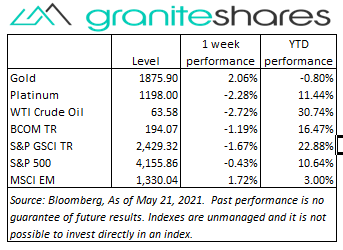

Energy prices were all lower last week. Crude oil prices fell just under 3% and gasoline prices decreased 2.5%. Natural gas prices dropped 1.4%.

Energy prices were all lower last week. Crude oil prices fell just under 3% and gasoline prices decreased 2.5%. Natural gas prices dropped 1.4%. - Grain prices were mixed with wheat and soybean prices lower and corn prices higher. Wheat prices fell between 4.5% and 5% and soybean prices dropped just under 4%. Corn prices increased 2.5%.

- Base metal prices, except for zinc prices, were all lower. Aluminum and copper prices decreased nearly 4% and nickel prices lost about 4.5%. Zinc prices increased a little over 1%.

- Precious metal prices were mixed with gold and silver prices higher and platinum prices lower. Gold prices increased 2%, silver prices were up ½ percent and platinum prices fell a little over 2%.

- The Bloomberg Commodity Index decreased a little over 1%, dragged lower by falling energy, grain and base metal prices but supported by increasing precious metal and livestock prices.

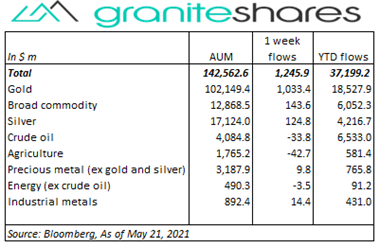

- Good inflows into commodity ETPs last week, primarily driven by gold ETP inflows. Gold ETP inflows amounted to just over $1 billion while broad commodity and silver ETPs saw inflows of $140 million and $125 million, respectively. Crude oil and agriculture ETPs experienced small outflows of about $30 million and $40 million, respectively.

Commentary

U.S stock markets struggled last week with growing inflation concerns unsettling investors and pressuring stock prices lower. FOMC minutes, released Wednesday, revealed some members thought it may be necessary in the near future to discuss scaling back asset purchases, adding to concerns the Fed may act to reduce its accommodative monetary policy sooner than expected. Increased cryptocurrency volatility also added to stock markets’ malaise contributing to investor concerns regarding asset valuations vis a vis a less accommodative Fed. Thursday’s post-pandemic low jobless claims release supported stock prices pushing the S&P 500 Index up 1% and the Nasdaq Composite Index higher by just under 2%. Friday’s much better-than-expected PMI Composite Flash seemingly had little effect on markets. The 10-year U.S. Treasury rate, up 4bps through Wednesday, closed the week unchanged. At week’s end, the S&P 500 Index decreased 0.4% to 4,155.86, the Nasdaq Composite Index increased 0.3% to 13,470.99, the Dow Jones Industrial Average fell 0.5% to 34,207.84, the 10-year U.S. Treasury rate was unchanged at 1.63% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.3%.

U.S stock markets struggled last week with growing inflation concerns unsettling investors and pressuring stock prices lower. FOMC minutes, released Wednesday, revealed some members thought it may be necessary in the near future to discuss scaling back asset purchases, adding to concerns the Fed may act to reduce its accommodative monetary policy sooner than expected. Increased cryptocurrency volatility also added to stock markets’ malaise contributing to investor concerns regarding asset valuations vis a vis a less accommodative Fed. Thursday’s post-pandemic low jobless claims release supported stock prices pushing the S&P 500 Index up 1% and the Nasdaq Composite Index higher by just under 2%. Friday’s much better-than-expected PMI Composite Flash seemingly had little effect on markets. The 10-year U.S. Treasury rate, up 4bps through Wednesday, closed the week unchanged. At week’s end, the S&P 500 Index decreased 0.4% to 4,155.86, the Nasdaq Composite Index increased 0.3% to 13,470.99, the Dow Jones Industrial Average fell 0.5% to 34,207.84, the 10-year U.S. Treasury rate was unchanged at 1.63% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.3%.

Coronavirus-related demand concerns from Asia (in particular India), reports and speculation on the possible removal of sanctions on Iran, inflation concerns and a greater-than-expected build in U.S. inventories worked to move oil prices lower last week. Down over 5%, through Thursday, WTI crude oil prices rallied just under 3% Friday on optimism surrounding post-Covid demand.

Growing concerns inflation may be an issue requiring the Fed to tighten monetary policy soon than later, increasing volatility and growing uncertainty regarding stock and other asset valuations, helped move gold prices higher last week. Additionally, increased cryptocurrency volatility may have spurred cryptocurrency investors to move out of cryptocurrencies and into gold.

Copper prices, up over 1.5% through Tuesday on supply concerns, dropped over 3% Wednesday after China announced it would work to prevent “unreasonable” price increases. Copper prices continued lower the remainder of the week. Other base metals performed similarly, dropping sharply on Wednesday and then continuing lower the rest of the week. Zinc prices were the exception. Up over 4% through Tuesday on reports a power shortage in China could significantly reduce production, zinc prices fell almost 4% Wednesday in sympathy with copper prices and then increased 1% the remainder of the week.

Wheat and soybean prices moved lower last week with most of the decrease occurring Wednesday with reports investment funds liquidated positions in the midst of increased uncertainty regarding changes in the Fed’s monetary policy and, as a result, asset value levels. Wheat prices were also pressured lower by expectations of good U.S. harvests. Corn prices, bolstered by strong Chinese demand, ended the week higher.

Coming up this week

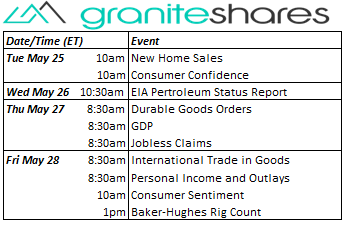

Fairly light week with consumer confidence and consumer sentiment bookmarking the week and highlighted by GDP on Thursday.

Fairly light week with consumer confidence and consumer sentiment bookmarking the week and highlighted by GDP on Thursday.- New Home Sales and Consumer Confidence on Tuesday.

- Durable Goods Orders, GDP and Jobless Claims on Thursday.

- International Trade in Goods, Personal Income and Outlays and Consumer Sentiment on Friday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.