Commodities & Precious Metals Weekly Report: Dec 18

Posted:

Key points

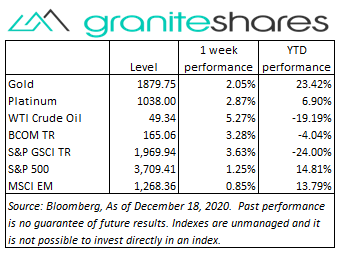

Energy prices were all higher again last week with prices rising across the board between 4.5% and 5.5%. Natural gas prices were the sole exception, increasing 2.5%.

Energy prices were all higher again last week with prices rising across the board between 4.5% and 5.5%. Natural gas prices were the sole exception, increasing 2.5%.- Corn and soybean prices increased sharply last week, with corn prices up almost 3.5% and soybean prices up 5%. Wheat prices fell between 1% and 2%.

- Base metal prices were all higher last week. Copper and zinc prices rose the most, increasing 3%. Nickel prices were up about 1% and aluminum prices gained a little over 1.5%.

- Precious metal prices were all higher last week. Silver prices increased the most, gaining over 4%, followed by platinum prices, up about 3% and then gold prices, up about 2%

- The Bloomberg Commodity increased strongly last week, rising 3.3%. The energy and grains sector were primarily responsible for the increase. All sectors contributed to the increase with energy, grains and precious metals sectors increasing the most.

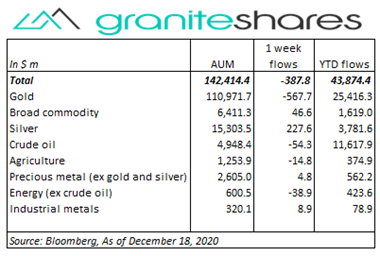

- Total assets in commodity ETPs fell last week, losing about $400 million. Gold ETP outflows were partially offset by silver ETP inflows.

Commentary

Despite greater-than-expected jobless claims, a larger-than expected decline in retail sales and increased restrictions resulting from rising Covid-19 cases, U.S. stock markets rose last week primarily on hopes of passage of a scaled-down fiscal stimulus package. Moderna’s Covid-19 vaccine was approved for emergency use by the FDA on Friday while the first doses of Pfizer’s vaccine were administered Monday. The FOMC announcement following the completion of its two-day meeting on Wednesday was mainly as expected with no changes in interest rate policy or buyback programs, though the Fed did increase its GDP growth forecast for 2021 and scaled back slightly its forecasted GDP decline for 2020. The U.S. dollar weakened significantly last week with longer-term U.S. interest rates rising, resulting mainly from increased “risk-on” market sentiment supported by increased expectations of passage of a U.S. stimulus package before year-end At week’s end the S&P 500 Index increased 1.3% to 3,709.41, the Nasdaq Composite Index increased 3.1% to 12,755.64, the 10-year U.S. Treasury rate rose 5bps to 95bps and the dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.1%.

Despite greater-than-expected jobless claims, a larger-than expected decline in retail sales and increased restrictions resulting from rising Covid-19 cases, U.S. stock markets rose last week primarily on hopes of passage of a scaled-down fiscal stimulus package. Moderna’s Covid-19 vaccine was approved for emergency use by the FDA on Friday while the first doses of Pfizer’s vaccine were administered Monday. The FOMC announcement following the completion of its two-day meeting on Wednesday was mainly as expected with no changes in interest rate policy or buyback programs, though the Fed did increase its GDP growth forecast for 2021 and scaled back slightly its forecasted GDP decline for 2020. The U.S. dollar weakened significantly last week with longer-term U.S. interest rates rising, resulting mainly from increased “risk-on” market sentiment supported by increased expectations of passage of a U.S. stimulus package before year-end At week’s end the S&P 500 Index increased 1.3% to 3,709.41, the Nasdaq Composite Index increased 3.1% to 12,755.64, the 10-year U.S. Treasury rate rose 5bps to 95bps and the dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.1%.

Both Brent and WTI crude oil prices were higher last week despite increasing Covid-19 cases globally and a return to increased restrictions or lockdowns. Positive Covid-19 vaccine news, including the emergency approval of Moderna’s vaccine in the U.S., increased expectations of congress pushing through a fiscal stimulus package before year-end, a larger-than-expected fall in U.S. oil inventories and a weakening U.S. dollar combined to help move oil prices higher.

Gold prices moved higher last week supported mainly by a weaker U.S. dollar. Increased expectations of passage of a U.S. stimulus package, the Fed’s continued application of extremely accommodative monetary policy and, perhaps, nascent concerns of future inflation helped weaken the U.S. dollar and support gold, silver and platinum prices.

Base metal prices were all higher last week benefiting from strong Chinese economic reports (including industrial production and retail sales), increased hopes a U.S. stimulus package, continued accommodative U.S. monetary policy, positive Covid-19 vaccine news, an extension of UK-EU trade talks and a weaker U.S. dollar. Copper prices are at 8-year highs while nickel prices, spurred by stainless steel and battery demand, are close to year-to-date highs.

Corn and Soybean prices continued to be supported by dry weather in South America and lowered harvest expectations in the U.S. Wheat prices, though lower on the week after giving up some of the previous week’s gains, moved higher Thursday on growing expectations Russia may scale back wheat exports by applying export duties as well as on reduced Russian harvest forecasts.

Coming up this week

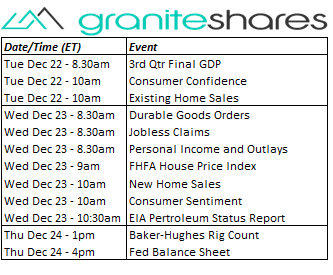

Another busy data week especially given it’s a holiday-shortened trading week. Of note is Monday’s GDP number and a number of housing related releases. Most data is scheduled for Wednesday.

Another busy data week especially given it’s a holiday-shortened trading week. Of note is Monday’s GDP number and a number of housing related releases. Most data is scheduled for Wednesday.- 3rd Qtr Final GDP, Consumer Confidence and Existing Home Sales on Tuesday.

- Durable Goods Orders, Jobless Claims, Personal Income and Outlays, FHFA House Price Index, New Home Sales and Consumer Sentiment on Wednesday.

- The Fed Balance Sheet on Thursday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Thursday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.