Commodities & Precious Metals Weekly Report: Jun 21

Posted:Key points

- Except for natural gas all energy futures prices moved higher last week. WTI and Brent crude oil prices increased 8.6% and 5.6%, respectively, gasoline prices increased 6.2%, heating oil prices rose 4.7% and gasoil prices gained 4.2%. Natural gas prices fell 9.6%.

- The grain sector was the worst performing sector last week. Chicago and Kansas wheat prices lost 2.1% and 4.9%, respectively, and corn and soybean prices decreased 4. 9% and 2.4%, respectively.

- With the exception of zinc, all base metal prices increased last week. Copper and nickel prices increased the most, rising 2.8% and 1.9%, respectively while aluminum prices increased 0.2%. Zinc prices fell 0.5%.

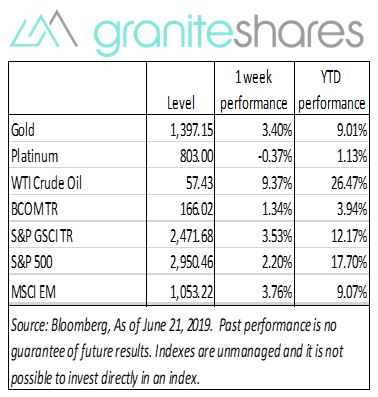

- Gold and silver prices moved higher again last week while platinum prices moved slightly lower. Gold prices rose 3.4%, and silver prices gained 3.3%. Platinum prices decreased 0.4%.

- The S&P GSCI outperformed the Bloomberg Commodity Index last week with the S&P GSCI increasing 3.53% versus the Bloomberg Commodity Index increasing 1.34%. The S&P GSCI’s larger exposer to energy but smaller exposure to natural gas and grains was the primary reason for its better performance.

- Total assets in commodity ETPs increased $1,832.5m last week. Gold ($1,701.6m), silver ($45.7m), broad commodity ($32.6m) and crude oil ($27.2m) ETP inflows were primarily responsible for the increase.

Commentary

Despite ECB statements indicating more stimulus would be needed and greatly increased tensions between the U.S. and Iran precipitated by Iran’s shooting down of a U.S. drone on Thursday, the U.S. dollar sharply weakened following U.S. Federal Reserve Bank Chairman Jerome Powell’s comments – at the end of the 2-day FOMC meeting – that the Fed would act as needed to sustain economic growth. The 10-year U.S. Treasury rate, which dropped below 2% intraday but never closed below 2% , finished the week off its Wednesday’s lows with increased optimism of reduced U.S.-China trade frictions. U.S. stock markets moved higher last week, though the S&P 500 Index closed slightly lower than its Thursday’s high. At week’s end the U.S. dollar weakened 1.4%, the S&P 500 Index rose 2.2% and the 10-year U.S. Treasury irate fell 2 bps to 2.06%.

WTI and Brent crude oil prices moved higher early in the week supported by Saudi Arabia self-imposed additional production cuts, continued efforts to extend OPEC+ production cutbacks past June and greater-than-expected U.S. oil inventory drawdowns. Mid-East tensions, already high due to tanker attacks attributed to Iran the previous week, moved even higher following Iran’s shooting down a U.S. drone on Thursday, pushing crude oil prices to their biggest weekly gain in almost 2 years.

Nickel prices moved higher throughout the week on continued supply concerns due to flooding in Indonesia, the world’s largest nickel exporter. Copper prices experienced a zig-zag week supported by supply concerns due to striking workers at Codelco, a Chilean copper mine, and off-and-on optimism over reduced trade tensions between the U.S and China.

Gold prices moved higher again last week, closing just below $1400 per ounce and reaching an almost 6-year high on the back of increased tensions between the U.S. and Iran and increased expectations the U.S Federal Reserve Bank would lower interest rates at least two times this year. Silver prices moved higher with gold prices, but closed off their Thursday’s high while platinum prices moved slightly lower.

Corn and wheat prices moved lower over uncertainty of the amount of acres planted this spring due to unusually wet weather. Soybean prices, up almost 2%, through Thursday, fell 1.4% on Friday with improved weather forecasts increasing expectations of spring plantings.

Coming up this week

- New home sales on Tuesday.

- Durable goods orders and international trade in goods on Tuesday.

- Jobless claims and final 1st Qtr GDP number on Thursday.

- Personal income and outlays on Friday.

- EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.