Commodities & Precious Metals Weekly Report: Sep 10

Posted:

Key points

Energy prices were mainly higher again last week with only gasoil and heating oil prices falling slightly. Natural gas prices rose almost 4.5%. WTI and Brent crude oil prices were up about ½ percent and gasoline prices rose about ¼ percent.

Energy prices were mainly higher again last week with only gasoil and heating oil prices falling slightly. Natural gas prices rose almost 4.5%. WTI and Brent crude oil prices were up about ½ percent and gasoline prices rose about ¼ percent.- Grain prices fell again last week. Chicago and Kansas wheat prices decreased close to 5.5% while corn prices fell 1 ¼ percent and soybean prices decreased about ½ percent.

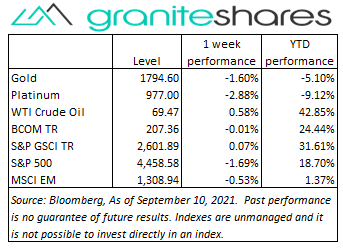

- Precious metal prices finished lower last week with gold prices falling a little over 1.5% and silver prices declining about 3.5%. Platinum prices fell 2.9%.

- Base metal prices were all higher with aluminum prices increasing the most, rising over 7%. Zinc prices rose over 4% and copper and nickel prices increased about 3%.

- The Bloomberg Commodity Index was almost unchanged. Gains in the energy and base metal sectors were offset by losses in the agriculture sector.

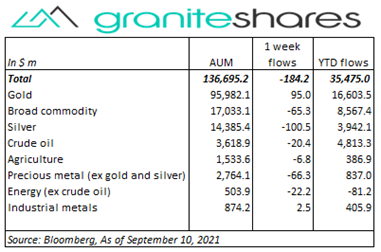

- $180 million net ETP outflows last week driven mainly by outflows from silver (-$101m), broad commodity (-$65m) and precious metals (ex-gold and silver) (-$66m) ETPs. Those outflows were partially offset by gold ETP inflows of $95 million.

Commentary

All three major U.S. stock market indexes finished lower last week, falling over 1.5% and with the Dow Jones Industrial Average performing the worst. Fallout from the previous week’s disappointing non-farm payroll report and the ending of supplemental unemployment benefits (in the remaining 25 states that still provide them) weighed on stock prices with increasing concerns of slowing U.S. economic growth. Concerns of slowing growth have increased doubts whether the Fed will begin tapering before year end while at the same time inflation continues to increase at historically high levels (Friday’s PPI release showed producer prices increased the most in its history). The confluence of increased expectations of weaker growth, surging inflation and a Fed potentially unwilling or unable to tighten monetary policy in the near future has added to investor uncertainty resulting in weaker stock markets. Concerns regarding congressional debt ceiling and budget negotiations also weighed on markets. At week’s end, the S&P 500 Index fell 1.7% to 4,458.58, the Nasdaq Composite Index dropped 1.6% to 15,115.5, the Dow Jones Industrial Average fell 2.2% to 34,607.46, the 10-year U.S. Treasury rate increased 1bps to 1.34% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7% percent.

All three major U.S. stock market indexes finished lower last week, falling over 1.5% and with the Dow Jones Industrial Average performing the worst. Fallout from the previous week’s disappointing non-farm payroll report and the ending of supplemental unemployment benefits (in the remaining 25 states that still provide them) weighed on stock prices with increasing concerns of slowing U.S. economic growth. Concerns of slowing growth have increased doubts whether the Fed will begin tapering before year end while at the same time inflation continues to increase at historically high levels (Friday’s PPI release showed producer prices increased the most in its history). The confluence of increased expectations of weaker growth, surging inflation and a Fed potentially unwilling or unable to tighten monetary policy in the near future has added to investor uncertainty resulting in weaker stock markets. Concerns regarding congressional debt ceiling and budget negotiations also weighed on markets. At week’s end, the S&P 500 Index fell 1.7% to 4,458.58, the Nasdaq Composite Index dropped 1.6% to 15,115.5, the Dow Jones Industrial Average fell 2.2% to 34,607.46, the 10-year U.S. Treasury rate increased 1bps to 1.34% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7% percent.

A volatile week for oil prices with prices falling then gaining close to 1.5% each day. Weaker-than-expected global economic growth as highlighted by the previous Friday’s much weaker-than-expected U.S. non-farm payroll report and Saudi Arabia’s lowering of official selling prices saw oil prices fall almost 1.5% Tuesday. Those losses were reversed Tuesday with reports Gulf oil producers had made little progress restoring production after Hurricane Ida. Oil prices then fell almost 1.7% Wednesday after China announced it would release reserves despite the EIA reporting much lower-than-expected gasoline inventories. Oil prices jumped over 2% higher Friday after reports China’s announcement was actually old news and referred to releases done early in the summer.

Gold prices fell almost 2% Tuesday, reversing all of last week’s gains as investors rethought the consequences of the previous Friday’s much weaker-than-expected U.S. payroll report. Muted inflation fears, despite a series of historically high increases over the last few months, combined with expectations the Fed will tighten its easy-money policies if not by the end of this year then early next year and Thursday’s ECB announcement it would maintain its ultra-accommodative monetary policy, strengthened the U.S. dollar, adversely affecting gold prices.

Despite significantly lower Chinese imports, copper prices ended the week higher supported by steeply falling inventory levels at both the LME and Shanghai exchanges. Nickel prices, increasing over 7% on the week, moved higher on strong stainless steel- and EV-related demand, production cutbacks in China as well as on falling inventory levels. Increased shipping and power costs have also worked to increase base metal prices.

Wheat prices moved sharply lower last week hurt by increased forecasted U.S. yield and ending stock projections and declining exports. Corn and soybean prices also moved lower (but less than wheat prices) mainly as a result of declining exports. The Port of Louisiana closure following Hurricane Ida has hindered U.S. grain exports but is now expected to reopen sooner than later.

Coming up this week

A little busier week data wise, but still relatively light. Highlights include CPI Tuesday, Industrial Production Wednesday and Retail Sales Thursday.

A little busier week data wise, but still relatively light. Highlights include CPI Tuesday, Industrial Production Wednesday and Retail Sales Thursday.- CPI on Tuesday.

- Import Export Prices and Industrial Production on Wednesday.

- Jobless Claims, Philadelphia Fed Mfg Index and Retail Sales on Thursday.

- Consumer Sentiment on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.