Commodities & Precious Metals Weekly Report: Oct 1

Posted:

Key points

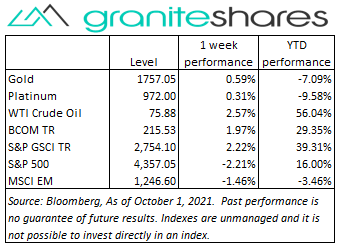

Energy prices were once again all higher last week. Natural gas prices rose 8% and gasoline prices increased over 5%. WTI and Brent crude oil prices increased 2.5% and 2.8%. respectively.

Energy prices were once again all higher last week. Natural gas prices rose 8% and gasoline prices increased over 5%. WTI and Brent crude oil prices increased 2.5% and 2.8%. respectively.- Grain prices were mainly higher with wheat and corn prices increasing but soybean prices falling. Chicago and Kansas wheat prices rose 4.4% and 5.5%, respectively and corn prices rose almost 3%. Soybean prices fell 3%.

- Precious metal prices were all higher. Gold and silver prices increased about ½ percent and platinum prices rose 1/3 percent.

- Base metal prices moved lower last week. Nickel and zinc prices fell 7.4% and 4.8%, respectively. Aluminum and copper prices decreased about 2 ¼ percent.

- The Bloomberg Commodity Index increased just short of 2%. The energy sector was responsible for most of the gains. The base metal sector was the only sector detracting from performance.

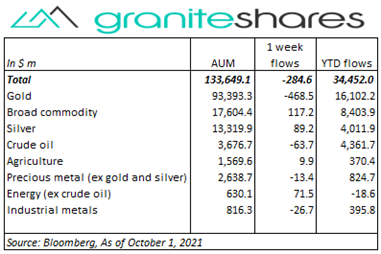

- Approximate $300 million ETP outflows last week predominantly from gold (-$469m) ETP outflows. Broad commodity ($117m), silver ($89m) and energy (ex-crude oil) ($72m) ETP inflows offset gold ETP outflows.

Commentary

Concerns of central bank tightening and growing inflation concerns precipitated steep declines in U.S. stock markets with all three major U.S. stock indexes falling 3% or more through Thursday. Fed Chairman Powell’s prepared remarks before Congress on Tuesday reiterated remarks made after the most recent FOMC meeting, saying the Fed could begin tapering in November and that higher inflation could last longer than initially anticipated before moderating toward the Fed’s 2% goal, uneased stock and bond markets with the 10-year U.S. Treasury rate increasing over 9bps through Tuesday, and U.S. stock markets dropping between 1.5% and 3%. Debt ceiling and government shutdown concerns and President Biden’s $3.5 trillion spending bill also unnerved markets with Congress' debt-ceiling impasse leading to warnings of default and credit rating downgrades. Stock markets rebounded Friday with investor risk-on appetite apparently returning with Congress approving a stopgap, government-funding bill and as the U.S dollar fell from its almost 1-year high and the 10-year U.S. Treasury rate finished the week only slightly higher. The PCE price index, released Friday, increased an as-expected 3.5%, perhaps helping to reduce inflation concerns. For the week, the S&P 500 Index fell 2.2% to 4,357.05, the Nasdaq Composite Index dropped 3.2% to 14,566.70, the Dow Jones Industrial Average decreased 1.4% to 34,327.45, the 10-year U.S. Treasury rate increased 1bp to 1.46% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.8% percent.

Concerns of central bank tightening and growing inflation concerns precipitated steep declines in U.S. stock markets with all three major U.S. stock indexes falling 3% or more through Thursday. Fed Chairman Powell’s prepared remarks before Congress on Tuesday reiterated remarks made after the most recent FOMC meeting, saying the Fed could begin tapering in November and that higher inflation could last longer than initially anticipated before moderating toward the Fed’s 2% goal, uneased stock and bond markets with the 10-year U.S. Treasury rate increasing over 9bps through Tuesday, and U.S. stock markets dropping between 1.5% and 3%. Debt ceiling and government shutdown concerns and President Biden’s $3.5 trillion spending bill also unnerved markets with Congress' debt-ceiling impasse leading to warnings of default and credit rating downgrades. Stock markets rebounded Friday with investor risk-on appetite apparently returning with Congress approving a stopgap, government-funding bill and as the U.S dollar fell from its almost 1-year high and the 10-year U.S. Treasury rate finished the week only slightly higher. The PCE price index, released Friday, increased an as-expected 3.5%, perhaps helping to reduce inflation concerns. For the week, the S&P 500 Index fell 2.2% to 4,357.05, the Nasdaq Composite Index dropped 3.2% to 14,566.70, the Dow Jones Industrial Average decreased 1.4% to 34,327.45, the 10-year U.S. Treasury rate increased 1bp to 1.46% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.8% percent.

Oil prices continued to move higher last week with Brent crude oil prices reaching intraday levels of $80/barrel. Despite larger-than-expected oil and distillate inventory increases (as reported by the EIA Wednesday), oil prices moved higher supported by both production shortages and growing global demand. OPEC+, which meets this week, continues to have difficulties meeting its agreed upon production levels and is not expected to alter production levels while Hurricane-Ida-hindered Gulf of Mexico production is slowly coming back online. On the demand side, China announced it will do what is necessary to maintain its energy and power supply implying cost is not an issue while India imports reached a 3-month high. On top of all this is the skyrocketing cost of natural gas (due to high demand, low inventory levels and production problems) increasing oil demand as a substitute.

Gold prices moved higher last week, recovering from a mid-week loss of over 1.5%. Growing concerns of imminent Fed tightening brought about by persistent higher-than-expected inflation sent 10-year U.S. Treasury rates higher, strengthened the U.S. dollar and helped move gold prices lower through Wednesday. Sentiment reversed Thursday, however (perhaps on the back of a higher-than-expected jobless claims and unease regarding Congress’ inability to address the debt-ceiling), with longer term interest rates falling to almost unchanged, the U.S. dollar coming off its almost 1-year highs and gold prices rallying nearly 2% to end the week higher.

Base metal prices moved lower last week, pressured by both China’s power crisis and growing expectations of imminent Fed tightening. While China’s power cutbacks (due to increased coal usage as a substitute for hard-to-get natural gas and oil) has reduced copper smelter output (reducing supplies), it has also reduced overall manufacturing activity, reducing demand. China began a week-long holiday Friday, also potentially affecting prices.

Grain prices all moved lower early in the week, following sharply declining equity markets, while awaiting Thursday’s USDA grain stocks report. Thursday’s release showed both greater-than-expected ending stocks and production for soybeans while reporting smaller-than-expected ending stocks and production for wheat. Corn ending stocks and production forecasts were approximately as expected.

Coming up this week

A light data-week accentuated by Friday’s Employment Report.

A light data-week accentuated by Friday’s Employment Report.- Factory Orders on Monday.

- International Trade in Goods and Services, PMI Composite and ISM Services Index on Tuesday.

- Jobless Claims on Thursday

- Employment Report on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.