Researches By Hips

The unfortunate reality is that a deep chasm stands between investor income requirements and what conventional strategies can now yield. Alternative Income may help bridge the divide.

Topic: Income

Publication Type: Investment Cases

Income Blueprint: HIPS Income Replacement

13 October, 2020 | GraniteShares

The unfortunate reality is that a deep chasm stands between investor income requirements and what conventional strategies can now yield. Alternative Income may help bridge the divide.

Income is one of the most basic, yet important needs of any portfolio—the capacity to generate enduring cashflows to fund expenses. While searching for sustainable yield is never easy, over the last decade income investing become a most unpalatable cocktail — one part frustration and two parts despair (add bitters to taste). These were the difficulties that pervaded income investing before COVID-19 struck, an economic shock that redoubled the income challenge to near unimaginable levels.

Topic: Income

Publication Type: Investment Cases

Crafting Your Income Blueprint: Strategies with HIPS

10 September, 2020 | GraniteShares

Income is one of the most basic, yet important needs of any portfolio—the capacity to generate enduring cashflows to fund expenses. While searching for sustainable yield is never easy, over the last decade income investing become a most unpalatable cocktail — one part frustration and two parts despair (add bitters to taste). These were the difficulties that pervaded income investing before COVID-19 struck, an economic shock that redoubled the income challenge to near unimaginable levels.

Mental accounting is a truly defining feature of the human condition. Find out how much of your income is mental, and how it may prevent you from acheiving your true income goals.

Topic: Alternative Income

Publication Type: Investment Cases

Overcoming Investing Fallacies, GraniteShares Perspective

27 March, 2020 | GraniteShares

Mental accounting is a truly defining feature of the human condition. Find out how much of your income is mental, and how it may prevent you from acheiving your true income goals.

If you thought achieving income yields was difficult, life will only get harder—the Fed that giveth can taketh away. Just as investors were getting accustomed to the taste of at least modestly non-zero rates, expectations have shifted swiftly.

Topic: Alternative Income

Publication Type: Investment Cases

Help! What Happened to My Income?

27 March, 2020 | GraniteShares

If you thought achieving income yields was difficult, life will only get harder—the Fed that giveth can taketh away. Just as investors were getting accustomed to the taste of at least modestly non-zero rates, expectations have shifted swiftly.

While generating sustainable yield for income investing has never been an easy task, the latest shockwaves to reverberate through interest rate markets have only compounded this challenge. The core of this problem for investors, whether retirees, long-term savers, or anyone looking to diversify their returns, is they are probably looking for yield in all the wrong places.

Topic: Income

Publication Type: Investment Cases

Seeking Yield: Finding 7% Income in Today’s Market

27 March, 2020 | GraniteShares

While generating sustainable yield for income investing has never been an easy task, the latest shockwaves to reverberate through interest rate markets have only compounded this challenge. The core of this problem for investors, whether retirees, long-term savers, or anyone looking to diversify their returns, is they are probably looking for yield in all the wrong places.

GraniteShares, a disruptive exchange-traded fund (ETF) company, debuted a revised methodology for the index underlying the GraniteShares HIPS US High Income ETF (NYSE Arca: HIPS), a high alternative income-focused fund that invests in a diversified basket of pass-through securities.

Topic: Income

Publication Type: Viewpoints

GraniteShares Updates HIPS ETF Index Methodology

27 March, 2020 | GraniteShares

GraniteShares, a disruptive exchange-traded fund (ETF) company, debuted a revised methodology for the index underlying the GraniteShares HIPS US High Income ETF (NYSE Arca: HIPS), a high alternative income-focused fund that invests in a diversified basket of pass-through securities.

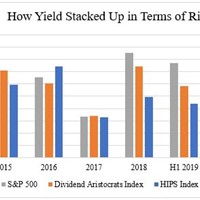

In the shifting sands of today’s market, finding sustainable income may be one the most challenging, yet pervasive concerns for investors. More troubling yet, market watchers may think they are positioned in income or dividend-oriented strategies, only to realize these approaches may deliver only marginally more income than the broad market.

Topic: Alternative Income

Publication Type: Investment Cases

Are You Actually Set up for Income?

27 March, 2020 | GraniteShares

In the shifting sands of today’s market, finding sustainable income may be one the most challenging, yet pervasive concerns for investors. More troubling yet, market watchers may think they are positioned in income or dividend-oriented strategies, only to realize these approaches may deliver only marginally more income than the broad market.

2019 has introduced myriad new varieties of yield to investors, including familiar fan-favorites such as flat and declining yields. For investors seeking a more exotic flare, markets have debuted negative and even inverted yields. However, only true aficionados will be able to savor the ultimate pairing of yield flavors, such as negative speculative yields, a true Italian masterpiece. Ciao Bella!

Topic: Alternative Income

Publication Type: Investment Cases

31 Flavors of Yield

27 March, 2020 | GraniteShares

2019 has introduced myriad new varieties of yield to investors, including familiar fan-favorites such as flat and declining yields. For investors seeking a more exotic flare, markets have debuted negative and even inverted yields. However, only true aficionados will be able to savor the ultimate pairing of yield flavors, such as negative speculative yields, a true Italian masterpiece. Ciao Bella!

GraniteShares is an independent, fully funded ETF company headquartered in New York City. GraniteShares’ ETF suite includes one of the lowest-cost physical gold ETFs (BAR), a broad-based commodity ETF (COMB), an ETF that seeks to exclude U.S. large cap companies most likely to suffer from technological disruption over the long term (XOUT), a high alternative income-focused fund that invests in pass-through securities (HIPS) and the lowest-cost* physical platinum ETF (PLTM). GraniteShares has experienced robust growth in 2019, recently surpassing $700 million in total assets under management.

Topic: Income

Publication Type: Investment Cases

GraniteShares Announces Change in ETF Lineup

27 March, 2020 | GraniteShares

GraniteShares is an independent, fully funded ETF company headquartered in New York City. GraniteShares’ ETF suite includes one of the lowest-cost physical gold ETFs (BAR), a broad-based commodity ETF (COMB), an ETF that seeks to exclude U.S. large cap companies most likely to suffer from technological disruption over the long term (XOUT), a high alternative income-focused fund that invests in pass-through securities (HIPS) and the lowest-cost* physical platinum ETF (PLTM). GraniteShares has experienced robust growth in 2019, recently surpassing $700 million in total assets under management.

Firm’s low-cost gold ETF, BAR, leads the way pushing over $430 million

NEW YORK– GraniteShares, a disruptive exchange-traded fund (ETF) company, has become one of the fastest-growing asset managers in the U.S. by accumulating over $500 million in assets under management (AUM), representing 1,180 percent growth over the last year alone.*

This surge is led by the GraniteShares Gold Trust (NYSE Arca: BAR), which has swelled past $430 million in AUM**, having already attracted $113 million in 2019. With an expense ratio of just 17.49 basis points, BAR is one of the lowest-cost ways to invest in gold.

Topic: Commodities , Alternative Income

Publication Type: Viewpoints

GraniteShares AUM Surges by 1180% Reaching $500M in First Year

28 January, 2019 | GraniteShares

Firm’s low-cost gold ETF, BAR, leads the way pushing over $430 million

NEW YORK– GraniteShares, a disruptive exchange-traded fund (ETF) company, has become one of the fastest-growing asset managers in the U.S. by accumulating over $500 million in assets under management (AUM), representing 1,180 percent growth over the last year alone.*

This surge is led by the GraniteShares Gold Trust (NYSE Arca: BAR), which has swelled past $430 million in AUM**, having already attracted $113 million in 2019. With an expense ratio of just 17.49 basis points, BAR is one of the lowest-cost ways to invest in gold.