BP Q2 Earnings Report 2023

13 Sep, 2023 | GraniteShares

Available for trading on London Stock Exchange.

GraniteShares 3x Short BP Daily ETP is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x Short BP PLC Index that seeks to provide -3 times the daily performance of BP p.l.c. shares.

For example, if BP p.l.c. rises by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments. However, if BP p.l.c. falls by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments.

BP (NYSE: BP) is a British oil exploration, extraction, refining and sales company. After its merger with Amoco, Atlantic Richfield and Burmah Castrol, it became the largest company in the UK and the third largest oil company in the world. The company is also known for some of its scandalous industrial accidents, the biggest being the one in the Gulf of Mexico in 2010. Since 2020, BP has announced its ambition to become a Carbon Neutral company by 2050 or earlier.

Internationally, BP is present in more than 100 countries and employs about 68,000 people in 2020. BP's main competitors are Shell, ExxonMobil, and Chevron.

13 Sep, 2023 | GraniteShares

04 Jul, 2022 | GraniteShares

16 Dec, 2020 | GraniteShares

07 Mar, 2023 | GraniteShares

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| London Stock Exchange | GBX | 3SBP | XS2620728274 | BR103B9 |

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

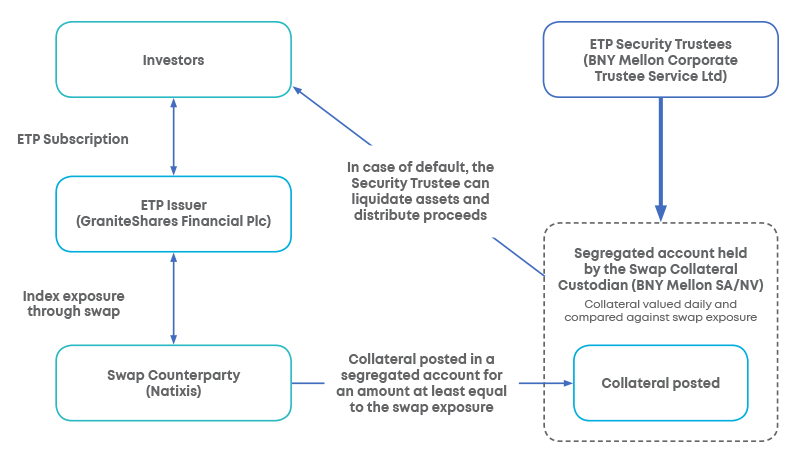

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.